During our annual summer trip to visit our children’s grandparents, my wife, children and I attended a family reunion in the Sandhills of Nebraska. Afterward we did something I have wanted to

|

| Chiney Rock, Western Nebraka

|

do for many years. We traveled farther west to see the most distinctive natural landmark on the old Oregon Trail— Chimney Rock. Upon viewing this magnificent geological formation, I was, among other things, provoked to investigate personal accounts of the landmark from Oregon Trail travelers. I discovered a fascinating work by Ezra Meeker,

The Ox Team or the Old Oregon Trail 1852-1906. It was a book published in 1906 Meeker wrote to commemorate “Pioneers who fought the battle of peace and wrested Oregon from British rule.”

Meeker provides a firsthand record of his journey from Iowa to the West along the Oregon Trail in 1852. I found that the book contains several passages that illuminate several important economic principles. One of which is the importance of the

|

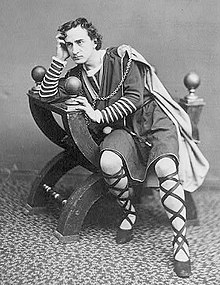

| Ezra Meeker (1830 - 1928) |

market, that vast network of voluntary exchange, for the development of the division of labor and, hence, society.

Ezra Meeker was born and raised near Indianapolis, Indiana. Soon after he was married, he and his wife decided to move west to Eddyville, Iowa, with the intention of developing their own farm on their own land. They thought their first Iowa winter weather harsh and unpleasant. They also found that, although the soil rich for farming, there were no transportation networks, linking them to markets. Meeker writes,

The country was a wide open, rolling prairie, a beautiful country indeed, —but what about a market? No railroads, no wagon roads, no cities, no meeting-houses, no schools; the prospect looked drear. (The Ox Trail, p. 21)

Note that among other challenges, Meeker cited a lack of markets as a primary reason for moving on. Without access to markets, they simply could not make a living farming. It was this final evaluation of their situation which prompted Meeker and his bride, plus a new infant, to proceed west along theOregon Trail the following year.

Meeker's actions illustrate exactly what Ludwig von Mises meant when he referred to the division of labor as the “fundamental social phenomenon.” It is so, because the division of labor is the reason why communities form. People move to different locales and specialize in different vocations, because it is beneficial to do so. With no way to bring agricultural products to market, Ezra Meeker and others would merely be wasting precious resources attempting to farm at that time and place in Iowa. Anyone who rejects the importance of the division of labor and markets rooted in voluntary exchange, fail to understand the history of the development of our nation.