The Mises Reader is intended to give a taste of the many facets of Mises’s thought in a way that accessibly communicates most of his key contributions to the social sciences. It therefore includes excerpts from his larger and more technically demanding works side-by-side with shorter, more introductory articles and lectures. The finished product is sort of an intelligent person’s guide to the work of Ludwig von Mises. It is especially suitable for those with an interest in Mises, but find jumping right into Human Action, Socialism, or The Theory of Money and Credit rather daunting. The hope is to give the reader a survey of Mises’s insights in a format that nourishes his intellectual soul, while also whetting the appetite for his larger corpus of work. Those ready to dive into deeper Misesian waters are encouraged to pick up The Mises Reader Unabridged which contains all of the material in The Mises Reader plus over 125 pages of additional material, primarily from his more scholarly works. It is hoped that together these two volumes will foster a rising generation of citizens more thoroughly acquainted with sound economics and the principles of the free society.

Tuesday, December 27, 2016

The Mises Reader!

I have edited a new book The Mises Reader published by the Ludwig von Mises Institute. In the introduction to the volume I write:

Saturday, November 5, 2016

International Conference of Prices and Markets

I just spent a tremendous day at the 2016 International Conference of Prices and Markets! I was blessed to present a paper on modern growth theory in light of Ludwig von Mises. I was also blessed to hear papers by David Howden, Glenn Fox, George Bragues, and Pierre Desrochers. A good time was had by all.

Thursday, September 29, 2016

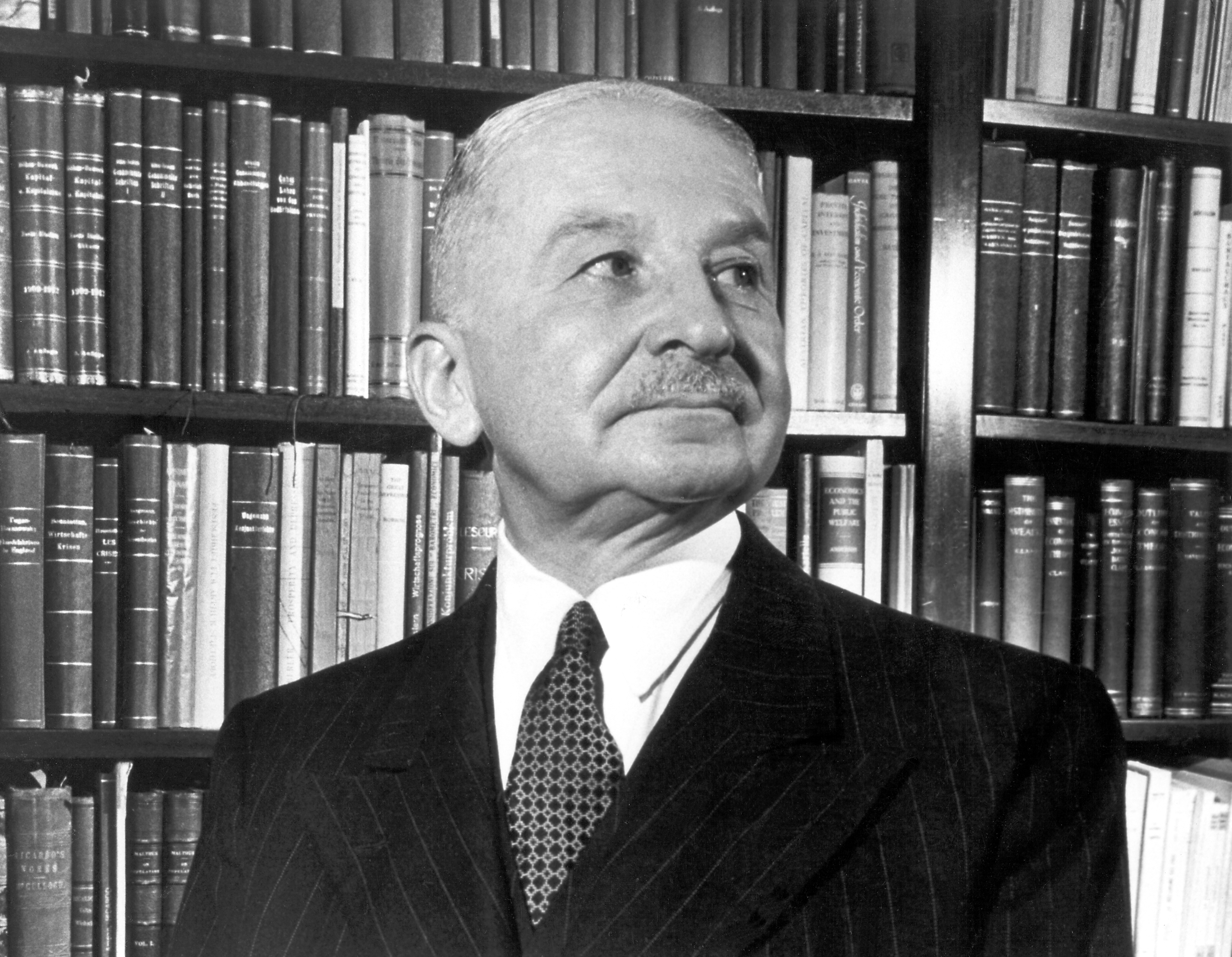

Ludwig von Mises and My Life As an Economist

Ludwig von Mises once said that it was his reading Carl Menger's Principles of Economics that made him an economist. Well the same thing happened to me when I read Mises' Human Action. I documented the importance that book had on my life as a student in an address I gave at a conference celebrating the publication of the Scholars Edition of Human Action by the Ludwig von Mises Institute. Today is the 135th anniversary of Mises' birth, so I take this opportunity to remember him and the importance of his work in my life. What I said those many years ago are still true today:

Ludwig von Mises once said that it was his reading Carl Menger's Principles of Economics that made him an economist. Well the same thing happened to me when I read Mises' Human Action. I documented the importance that book had on my life as a student in an address I gave at a conference celebrating the publication of the Scholars Edition of Human Action by the Ludwig von Mises Institute. Today is the 135th anniversary of Mises' birth, so I take this opportunity to remember him and the importance of his work in my life. What I said those many years ago are still true today:It is impossible to calculate the full benefits I have taken from Mises's Human Action. It showed me the truth of economics. It made me want to become an economist. It inspired me to be a scholar, and it set forth the rational case for liberty. It does the same for my students.

God providentially used Mises' work to confirm me in my calling as an economist and college professor. For that I continue to be grateful.

Sunday, September 18, 2016

Survivied by His Wife

In a classic comedy routine I remember watching on the original Late Night with David Letterman . Alan King uses Ludwig von Mises' obituary as part of the act. I remember how stunned I was to hear Mises' name (and somewhat impressed that I knew who he was, being a young economics major). You can view it by clicking here.

Thursday, August 4, 2016

Bohm-Bawerk at Harvard

In past graduate course exams that is. Following are two questions from the final exam for Harvard's graduate level Economic Theory course from 1912 posted at the fascinating blog Economics in the Rear-View Mirror currated by Irwin Collier.

- What three grounds explain, according to Böhm-Bawerk, the preference for present goods over future? Which of them does he conclude to be the most important? State Fisher’s criticism; and give your own opinion on the controverted question.

- “In the present condition of industry, most sales are made by men who are producers and merchants by profession. . . .For them, the subjective use value of their own wares is, for the most part, very nearly nil. … In sales by them the limiting effect which, according to our theoretical formula, would be exerted by the valuation of the last seller, practically does not come into play.” — Böhm-Bawerk.

What is the ” theoretical formula “? and what is the importance of the qualification here stated?

Friday, July 29, 2016

The Division of Labor and Social Order

Mises University is in full swing at The Ludwig von Mises Institute this week. A couple of days ago my department chair, Jeffrey Herbener gave the following lecture on the importance of the division of labor for society.

This is the quality of economic education students at Grove City College receive every day.

This is the quality of economic education students at Grove City College receive every day.

Monday, July 18, 2016

Rothbard University!

This week I will be joining an illustrious faculty lecturing at Rothbard University offered by Mises Institute Canada. The event will be held on the campus of the University of Toronto. On the schedule are lectures by professors such as David Howden, Glenn Fox, and Pierre Derochers. I will be lecturing on the topics of entrepreneurship, money, economic development, income redistribution, and labor unions. These are topics that I teach about at Grove City College and that I have written about in my book, Foundations of Economics. I trust a good time shall be had by all.

This week I will be joining an illustrious faculty lecturing at Rothbard University offered by Mises Institute Canada. The event will be held on the campus of the University of Toronto. On the schedule are lectures by professors such as David Howden, Glenn Fox, and Pierre Derochers. I will be lecturing on the topics of entrepreneurship, money, economic development, income redistribution, and labor unions. These are topics that I teach about at Grove City College and that I have written about in my book, Foundations of Economics. I trust a good time shall be had by all.Tuesday, July 12, 2016

The Fed and Moral Hazard

It has been noted by others that the central bank, by having a monopoly on issuing money and by serving as the lender of last resort, ostensibly to promote and maintain financial stability, actually promotes less measured and more risky behavior on the part of banks, which causes the very financial instability the Fed was created to remove.

A new paper by Mark A. Carlson and David Wheelock, in a new working paper at the St. Louis Federal Reserve Bank, affirm this conclusion. The abstract is as follows:

As a result of legal restrictions on branch banking, an extensive interbank system developed in the United States during the 19th century to facilitate interregional payments and flows of liquidity and credit. Vast sums moved through the interbank system to meet seasonal and other demands, but the system also transmitted shocks during banking panics. The Federal Reserve was established in 1914 to reduce reliance on the interbank market and correct other defects that caused banking system instability. Drawing on recent theoretical work on interbank networks, we examine how the Fed’s establishment affected the system’s resilience to solvency and liquidity shocks and whether these shocks might have been contagious. We find that the interbank system became more resilient to solvency shocks but less resilient to liquidity shocks as banks sharply reduced their liquidity after the Fed’s founding. The industry’s response illustrates how the introduction of a lender of last resort can alter private behavior in a way that increases the likelihood that the lender will be needed.

Recurrences of such financial crises' was the main ostensible reason the Fed was created. I write about the sharp contrast between Federal Reserve rhetoric and the real consequences of the Fed in the book The Fed at One Hundred.

Monday, July 4, 2016

My Thoughts on the Fourth of July

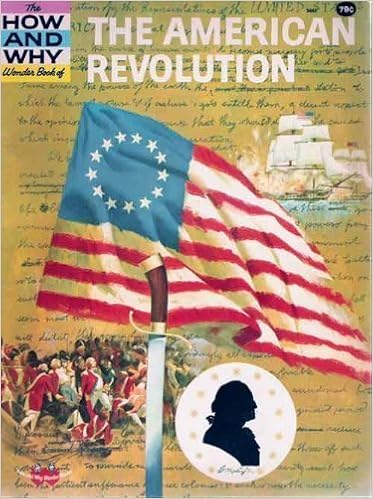

When I was a boy, one of my favorite holidays was Independence Day. I

was an enthusiastic student of the War for Independence. My favorite

book was the How and Why Wonder Book of the American Revolution

by Felix Sutton. I spent a lot of my childhood reading about the

colonial era, the lives of people like Sam Adams, Paul Revere, Thomas

Jefferson, Patrick Henry, and George Washington. I learned all about our

American forefathers’ struggle for liberty against a king who merely

treated them as revenue-generating pawns. I was nine years old when the

US celebrated its bicentennial and my mother wallpapered my room with a

red, white, and blue colonial American themed paper and I had various

prints of famous revolutionary war scenes hanging on the walls. I looked

forward every year to the day celebrating the signing of the

Declaration of Independence.

When I was a boy, one of my favorite holidays was Independence Day. I

was an enthusiastic student of the War for Independence. My favorite

book was the How and Why Wonder Book of the American Revolution

by Felix Sutton. I spent a lot of my childhood reading about the

colonial era, the lives of people like Sam Adams, Paul Revere, Thomas

Jefferson, Patrick Henry, and George Washington. I learned all about our

American forefathers’ struggle for liberty against a king who merely

treated them as revenue-generating pawns. I was nine years old when the

US celebrated its bicentennial and my mother wallpapered my room with a

red, white, and blue colonial American themed paper and I had various

prints of famous revolutionary war scenes hanging on the walls. I looked

forward every year to the day celebrating the signing of the

Declaration of Independence.Over the years, alas, my enthusiasm became dampened so that now, if I am exposed to any mainstream media celebrations of Independence Day, I do not feel the joy I once did. Instead I feel more like Charlie Brown at the beginning of A Charlie Brown Christmas. Remember in that childhood classic how, when Christmas approaches, Charlie Brown tells Linus that he knows he should be happy, but instead he always ends up feeling depressed. I increasingly get the same feeling as people gear up for 4th of July celebrations.

Now, much older and perhaps wiser, when I hear the popular media gushing about our freedoms, the Declaration of Independence, the Liberty Bell, Celebrate America concerts, and all the rest on the Fourth of July, instead of being happy, I feel a tinge of sadness. I like celebrating the Fourth of July by, say, gathering with friends, teaching my children about the Founding Fathers, reading the Declaration, and watching fireworks, but when I think about where we started and what we have become, like Charlie Brown I end up melancholy. This is because the politicians and the media talking heads clearly have no idea what they are talking about. Most seem to not even know what liberty really is. The only politician at the national level who spoke about freedom and the Constitution with actual conviction was Ron Paul and they laughed him off the stage. Instead, popular journalists and pundits try to make us believe that we are free because we are allowed to have other people vote away our liberties.

At the beginning of every major sporting event, Americans pay lip service to “the land of the free and the home of the brave,” but everywhere they are in economic chains. Last year total government spending was $6.4 trillion. That is $6.4 trillion with a t. That number amounts to over 36 percent of GDP. The Federal budget deficit the past fiscal year was $438 billion. Over the past eight years, our government debt has skyrocketed. By the end of this fiscal year, gross Federal government debt is expected to be over $19 trillion. That will be 106 precent of GDP.

Now, the important point to remember with respect to our freedom is that every single penny of government spending represents government control. When you spend money to purchase a loaf of bread, a tank of gas, or a pair of pants, you become owners of these economic goods and can use them as you see fit. When the government spends money, its bureaucrats gain control of economic resources. And the more of our resources under their control, the less free we become. . . .

Friday, July 1, 2016

Mark Thornton on the Natural Interest Rate in the WSJ

My friend and former professor, Mark Thornton, has a letter to the editor published in the Wall Street Journal commenting on the importance of the natural rate of interest for business cycle theory. He notes that all the FED needs to do to foster discovery of the natural rate of interest is to cease manipulating the money supply and, hence, the interest rate. Thornton writes:

Mark Thornton is now a Senior Fellow at the Ludwig von Mises Institute. He is one of the leading contemporary scholars in Austrian economics.

The Fed cannot “see” the natural rate of interest, but it is right before its eyes. You can achieve the natural rate by simply not increasing the money supply and withdrawing from interest-rate manipulation altogether.

Mark Thornton is now a Senior Fellow at the Ludwig von Mises Institute. He is one of the leading contemporary scholars in Austrian economics.

Wednesday, June 15, 2016

'Blind Robbery' Co-authored by Philipp Bagus Is Now Available in English

As reported on the BusinessWire:

Bagus gave the Sennholz Memorial Lecturer at the 2012 Austrian Student Scholars Conference at Grove City College. You can stream the lecture by clicking here. He is also author of In Defense of Deflation.This new books looks to be a welcome addition.

“The core problem of our society is its monetary system. It is a pure paper money standard, in which new money is created out of thin air and almost no citizen is conscious about this fact”, states Andreas Marquart, financial consultant and together with Philipp Bagus author of “Blind Robbery!: How the Fed, Banks and Government Steal Our Money”. Already a bestseller in Germany the book has now been published in English.

Together with Phillip Bagus, economic professor at the Universidad Rey Juan Carlos in Madrid, Marquart shows how money arises and why the current money is everything but good money. Furthermore the book explains the tremendous influence of the current bad money on almost every aspect of the society. It is certainly not limited to only the economic world. So Marquart and Bagus emphasize the importance of good and sound money for a society.

Bagus gave the Sennholz Memorial Lecturer at the 2012 Austrian Student Scholars Conference at Grove City College. You can stream the lecture by clicking here. He is also author of In Defense of Deflation.This new books looks to be a welcome addition.

Monday, May 30, 2016

Be Fruitful and Multiply

Anne Bradley of the Institute for Faith, Work and Economics has written a new booklet entitled Be Fruitful and Multiply: Why Economics Is Necessary for Making God-pleasing Decisions. In an interview of Bradley about the booklet she identifies the economics of Ludwig von Mises as a body of thought Christians should get to know. As she notes, even though Mises was not a Christian,

It sounds like an excellent primer on the importance of economics for Christians who seek to make wise choices on a daily basis and who desire to love their neighbor as themselves.

[H]is insights were really powerful. He observed the way humans behaved. He saw that there were a couple things that were needed to drive humans to act. One is that they need to feel uneasy with their current situation. They see there can be a better state, so they need to be looking into the future. And they need to see a way to get to that better situation. He understood that humans were purposeful, but fallible. So for him, it was “how do you think about that in the bigger picture of constructing a society that lets people seek their ends and try to maximize their own benefits?”

It sounds like an excellent primer on the importance of economics for Christians who seek to make wise choices on a daily basis and who desire to love their neighbor as themselves.

Tuesday, May 10, 2016

Socialism's Dismal Harvest: Venezuela Edition

One of the points I like to stress in my introductory economics course, as well in my course on Economic Expansion and Development is that socialism, when implemented, results in poverty, starvation, death, and cultural ossification. The more hard core socialist the system is, the worse its problems. Mary Anastasia O’Grady documents this in a short essay in the Wall Street Journal. It is an excellent primer in the problems of socialism in which she uses Leonard Read's "I, Pencil" to illustrate what any economic system must do if society is to survive. As O'Grady notes:

Once again history demonstrates what economic theory has told us for over a century: socialism is no laughing matter, unless we are prepared to chuckle at state-created poverty, starvation, and death.

In his craving for power, the late Hugo Chávez pledged to redistribute Venezuela’s wealth to the poor masses. The god-father of “21st-century socialism” seems to have been unaware that the resources he promised to shower on his people had to first be produced. . .

. . . Among the many stupidities that socialism promotes is the idea that by imposing price controls and forbidding profits, government can make food both cheap and widely available.

The opposite is true, and Venezuela proves the rule. An August-September 2015 survey by the multi-university, Caracas-based social and economic research project Encovi found that 87% of those polled reported that they did not have sufficient income for food. Their privation is a result of artificially holding down prices, which creates shortages. Consumers are forced to scurry about black markets looking for what they need and then pay dearly for it—if they can. They face killer inflation which, according to the central bank, was 180.9% on an annual basis in the fourth quarter of 2015, up from 82.4% in the first quarter of last year.

Once again history demonstrates what economic theory has told us for over a century: socialism is no laughing matter, unless we are prepared to chuckle at state-created poverty, starvation, and death.

Friday, April 22, 2016

Payday Loans May Cause Excessive Money Loss, But Don’t Throw the Baby Out With the Bathwater

That is the verdict of John Kiernan, personal finance editor for CardHub, a credit card information and marketing website. Kiernan interviewed me for the perspective of one economist on the issue. My thoughts on questions asked about the payday loan industry are at the bottom of the article.

Saturday, April 2, 2016

Jeff Herbener Gives the Mises Lecture

Today my friend and department chair, Jeffrey M. Herbener gives the Ludwig von Mises Memeorial lecture at the Austrian Economics Research Conference. You can watch the live stream of the the lecture below:

Friday, April 1, 2016

Austrian Economics Research Conference

The Austrian Economics Research Conference is in full swing and already the attendees have been treated by keynote lectures by Paul Gottried, David Cowan, and Bruce Yandle.

I was blessed to be part of a History of Economic Thought Session, at which I presented the paper, "Austrian Economics as the Solution for Economic Development Theory." The abstract for the paper is as follows:

Tomorrow we will be treated to the Mises Memorial lecture given by my friend and Department Chair Jefferey M. Herbener.

I was blessed to be part of a History of Economic Thought Session, at which I presented the paper, "Austrian Economics as the Solution for Economic Development Theory." The abstract for the paper is as follows:

Two conflicting theories of economic development developed during the Twentieth Century following the proliferation of Keynesianism. A direct descendent of Keynesian theory, the Harrod-Domar model fueled so-called capital fundamentalism—the doctrine that capital alone was the determinate of economic growth. The Solow growth model and subsequent empirical studies drawing on that model asserted contrarily that capital accumulation was an insignificant contributor to economic expansion, but that technology was the driver of continued prosperity. Both frameworks rely on mathematical models and, hence, suffer from problems of aggregation as well as the serious limitations of rarifying assumptions. Much unproductive debate could have been avoided if economic analysis by Ludwig von Mises and other Austrians had been more fully understood and assimilated into the larger body of economic development literature. Austrian capital theory and Mises’ conception of capital as a tool of economic calculation, not merely an aggregate of homogenous physical goods reveals the important relationship between saving and investment in capital accumulation and wise entrepreneurship within the market division of labor as distinct, yet interrelated engines of prosperity. Such a link also helps to resolve the true relationship between capital and technology as sources of economic progress.

Tomorrow we will be treated to the Mises Memorial lecture given by my friend and Department Chair Jefferey M. Herbener.

Thursday, March 24, 2016

Socialism: Communist, Conservative and Social-Democratic Style

This past Saturday I was again blessed to be a guest on the program A Plain Answer. The show is broadcast on the Redeemer Broadcasting radio network. Dan Elmendorf and I talk about socialism in some of its several varieties. This program is as timely as our current election cycle You can listen to the discussion by clicking here.

This past Saturday I was again blessed to be a guest on the program A Plain Answer. The show is broadcast on the Redeemer Broadcasting radio network. Dan Elmendorf and I talk about socialism in some of its several varieties. This program is as timely as our current election cycle You can listen to the discussion by clicking here.Chapter 18 of my book Foundations of Economics: A Christian View is devoted to this subject. In it, I discuss both the economics and ethics of socialism. For those looking for an in-depth investigation into various forms of socialism and its alternative, the free market, I recommend Hans-Hermann Hoppe's A Theory of Socialism and Capitalism.

Monday, February 22, 2016

More Resorces on Cuba

My most recent post featured links to a radio episode and magazine article that briefly mentioned the plight of citizens as it related to nutrition after the Castro Revolution. If you are interested in learning more about the consequences of socialism for cuba I recommend the following:

"Why Havana Had to Die."

This is an article one of my favorite conservative authors, Theodore Dalrymple. The piece is about fourteen years old and still as prescient as ever. The truth always is.

"Capitalism, Cuba, and Castro: A Report from Recent Travels"

This is a lecture by former Soviet economist Yuri Maltsev, presented at the Austrian Scholars Conference in 2004. He documents the tragic consequences of socialism for Cuba. Unfortunately, all we have is the audio recording, but the content is worth careful attention.

"Why Havana Had to Die."

This is an article one of my favorite conservative authors, Theodore Dalrymple. The piece is about fourteen years old and still as prescient as ever. The truth always is.

"Capitalism, Cuba, and Castro: A Report from Recent Travels"

This is a lecture by former Soviet economist Yuri Maltsev, presented at the Austrian Scholars Conference in 2004. He documents the tragic consequences of socialism for Cuba. Unfortunately, all we have is the audio recording, but the content is worth careful attention.

Saturday, February 20, 2016

Socialism Starves the People: Cuba Edition

“What were the three greatest successes of the revolution? Education, health, and defense. What were the three greatest failures? Breakfast, lunch, and dinner.”

---Cuban Food Joke

The radio program The Splendid Table recently featured a story about the rediscovery of good food in Cuba. One of the segments featured an interview with writer Tamar Adler whose piece "Why Cuba Is Becoming a Serious Culinary Destination" explains how the gastronomic life of Cubans is beginning to recover from decades of socialism.

You can listen to the segment and read excerpts from Adler's interview by clicking here.

Adler explains how Castro's revolution and regime drove the populace to the brink of starvation. Following the revolution, Cuba's international trade slowed to a crawl. In response to the question of how Cuba's isolation effected Cuba's culinary identity, Adler replied:

In her written article Adler elaborates:

While the program segment happily focuses on the recovery of the Cuban culinary scene after Fidel Castro's stepping down from power and the subsequent opening of Cuba, it also reminds us of how socialism actually impoverished the people by making their mundane, ordinary lives much more difficult to live. The Cuban socialist episode is another negative example of how socialism hurts the masses, the very set of people it promises to help.

---Cuban Food Joke

The radio program The Splendid Table recently featured a story about the rediscovery of good food in Cuba. One of the segments featured an interview with writer Tamar Adler whose piece "Why Cuba Is Becoming a Serious Culinary Destination" explains how the gastronomic life of Cubans is beginning to recover from decades of socialism.

You can listen to the segment and read excerpts from Adler's interview by clicking here.

Adler explains how Castro's revolution and regime drove the populace to the brink of starvation. Following the revolution, Cuba's international trade slowed to a crawl. In response to the question of how Cuba's isolation effected Cuba's culinary identity, Adler replied:

Severely. The worst of it really started with the collapse of the Soviet Union in the late '80s and early '90s. Cuba, like the U.S., was a petroleum-dependent, highly industrialized, agricultural society. It lost all of its oil imports when the Soviet Union collapsed, which resulted in just short of starvation nationwide.

Back before the island’s food markets and restaurants were nationalized in 1959, Cuba’s large upper middle class ate well. Then, private enterprise was forbidden. Food rationing began in 1962 and remains, via the libreta de abastecimiento (supplies booklet), which the journalist Patrick Symmes, who has been reporting on Cuba since the 1990s, has called “the foundational document of Cuban life.” The collapse of the Soviet Union around 1991 marked the beginning of the most artfully euphemized epoch I’ve heard of: Fidel Castro’s Special Period in Peacetime, during which Cuba lost up to 85 percent of its imports and exports. Farms went fallow. Cubans lived on sugar water until dinnertime. Stories abound of dairy cows eaten for meat, of street cats and zoo animals going missing. The weight of an average Cuban decreased by 30 percent

Friday, February 12, 2016

Wilhelm Röpke (1899 - 1966)

"I champion an economic order ruled by free prices and markets...the only economic order compatible with human freedom."

As I noted in these excerpts from my "Wilhelm Röpke: A Humane Economist" published in The Great Austrian Economists:

Wilhelm Röpke devoted his scholarly career to combating collectivism in economic, social, and political theory. As a student and proponent of the Austrian School, he contributed to its theoretical structure and political vision, warning of the dangers of political consolidation and underscoring the connection between culture and economic systems. More than any other Austrian of his time, he explored the ethical foundations of a market-based social order.He defended the free market from socialist cultural critics by pointing out that social crises and cultural decline are not the product of the free society; one needs to look to state control, political centralization, welfare, and inflation as a primary source of social decay. Röpke influenced the direction of post-war German economic reform, became a leading intellectual force in shaping the post-war American conservative movement, particularly its "fusionist" branch, and has been compared with Mises as an archetype of the individualist thinker. . . .

. . .From his earliest years, Wilhelm Röpke fought collectivist and statist power in every way an intellectual could. His tools included not only economic theory but also a vision of moral goodness rooted in Christian faith. As Hayek said of Röpke: "let me at least emphasize a special gift for which we, his colleagues, admire him particularly--perhaps because it is so rare among scholars: his courage, his moral courage." If are we concerned about fostering societies where people can live more humane lives, Röpke's advances in both Austrian economics and his vision of the good society deserve close attention.

Thursday, February 4, 2016

Herbener to Give the Ludwig von Mises Lecture

It is my very great pleasure to share that my friend and department chair, Jeff Herbener will be giving the prestigious Ludwig von Mises Memorial Lecture at this year's Austrian Economics Research Conference at the Ludwig von Mises Institute at Auburn, Alabama. The conference will be held March 31 through April 2. I encourage all who are interested in current scholarship in the Misesian tradition to register and attend.

I am convinced that Jeff is the most underrated Austrian economist working today. As Tom Woods is fond of noting, Jeff Herbener is the economist he has never been able to stump no matter what the question. He has a vast archive of written articles and recorded lectures available at Mises.org. He also has a variety of work for the public in the archive of The Center for Vision and Values at Grove City College. You can access an archive of much of his scholarly output by clicking here. He has edited two books, The Meaning of Ludwig von Mises and The Pure Time Preference of Interest and has contributed to Dissent on Keynes, The Great Austrian Economists and The Fed at One Hundred. He has also testified before a Congressional Sub-committee on the production of money and why we should eliminate the Federal Reserve. You can watch his testimony here:

I am convinced that Jeff is the most underrated Austrian economist working today. As Tom Woods is fond of noting, Jeff Herbener is the economist he has never been able to stump no matter what the question. He has a vast archive of written articles and recorded lectures available at Mises.org. He also has a variety of work for the public in the archive of The Center for Vision and Values at Grove City College. You can access an archive of much of his scholarly output by clicking here. He has edited two books, The Meaning of Ludwig von Mises and The Pure Time Preference of Interest and has contributed to Dissent on Keynes, The Great Austrian Economists and The Fed at One Hundred. He has also testified before a Congressional Sub-committee on the production of money and why we should eliminate the Federal Reserve. You can watch his testimony here:

Subscribe to:

Posts (Atom)