Monday, December 21, 2015

The Downside of Price Controls

Wednesday, November 25, 2015

Austrian Student Scholars Conference

From my department chair, Jeffrey Herbener:

Grove City College will host the twelfth annual Austrian Student Scholars Conference, February 26-27, 2016. Open to undergraduates and graduate students in any academic discipline, the ASSC will bring together students from colleges and universities across the country and around the world to present their own research papers written in the tradition of the great Austrian School intellectuals such as Ludwig von Mises, F.A. Hayek, Murray Rothbard, and Hans Sennholz. Accepted papers will be presented in a regular conference format to an audience of students and faculty.

Keynote lectures will be delivered by Drs. Mark Brandly and Matthew McCaffrey.

Cash prizes of $1,500, $1,000, and $500 will be awarded for the top three papers, respectively, as judged by a select panel of Grove City College faculty. Hotel accommodation will be provided to students who travel to the conference and limited stipends are available to cover travel expenses. Students should submit their proposals to present a paper to the director of the conference (jmherbener@gcc.edu) by January 15. To be eligible for the cash prizes, finished papers should be submitted to the director by February 1.

Grove City College will host the twelfth annual Austrian Student Scholars Conference, February 26-27, 2016. Open to undergraduates and graduate students in any academic discipline, the ASSC will bring together students from colleges and universities across the country and around the world to present their own research papers written in the tradition of the great Austrian School intellectuals such as Ludwig von Mises, F.A. Hayek, Murray Rothbard, and Hans Sennholz. Accepted papers will be presented in a regular conference format to an audience of students and faculty.

Keynote lectures will be delivered by Drs. Mark Brandly and Matthew McCaffrey.

Cash prizes of $1,500, $1,000, and $500 will be awarded for the top three papers, respectively, as judged by a select panel of Grove City College faculty. Hotel accommodation will be provided to students who travel to the conference and limited stipends are available to cover travel expenses. Students should submit their proposals to present a paper to the director of the conference (jmherbener@gcc.edu) by January 15. To be eligible for the cash prizes, finished papers should be submitted to the director by February 1.

Friday, October 30, 2015

Ritenour on Money

This past July I was blessed to lecture at Rothbard University sponsored by the Ludwig von Mises Institute Canada. One of the lectures I presented was an introduction to the nature of money. Mises Institute Canada has posted it on its YouTube channel. If you can stomach it, you can watch it below:

Thursday, October 22, 2015

Is Health Care a Right?

Caroline Baum says no as she gets to the heart of the political-economic problem with socialized health care. Countering Bernie Sanders recent statement, "When you look around the world, you see every other major country

providing health care to all people as a right, except the United

States," Baum explains,

A significant problem with declaring an economic good a right is that people immediately think it is the government's responsibility to either provide it for the masses or at least insure that it is provided. Because the good being declared a right is a scarce goods, other people will be forced to incur the costs of providing the good. Some will benefit while others will be harmed involuntarily.

The most obvious way the government could provide health care is for a fully socialized, single-payer government provided health care system--the kind that Bernie Sanders desires. Such a system would be a disaster. With the broken system we have now, the number one purchaser of medical services already is the government. The primary reason health care services are so expensive is that there is very little profit and loss calculation undertaken by anyone because the third-party-payer system drives a wedge between the demander of medical services (the patient) and the supplier of the services (the doctor and/or hospital). Sanders' proposal (and all single payers systems like it) drives the wedge even deeper and farther.

Additionally, any claims that, under a plan such as Sanders desires, we'll all be more healthy would be laughable if the issue were not so serious. What Sanders' plan will do is increase the demand for medical services, but it will not increase supply, so we should expect the same sort of shortages they experience in Great Britain's National Health Service. On the issue of government intervention in the health care industry, I highly recommend Colin Gunn's film Wait Till Its Free.

"The problem with his statement is that rights aren't the government's to give. John Locke, the 17th century English philosopher, wrote about inalienable rights: God-given rights that can't be taken away."

The most obvious way the government could provide health care is for a fully socialized, single-payer government provided health care system--the kind that Bernie Sanders desires. Such a system would be a disaster. With the broken system we have now, the number one purchaser of medical services already is the government. The primary reason health care services are so expensive is that there is very little profit and loss calculation undertaken by anyone because the third-party-payer system drives a wedge between the demander of medical services (the patient) and the supplier of the services (the doctor and/or hospital). Sanders' proposal (and all single payers systems like it) drives the wedge even deeper and farther.

Additionally, any claims that, under a plan such as Sanders desires, we'll all be more healthy would be laughable if the issue were not so serious. What Sanders' plan will do is increase the demand for medical services, but it will not increase supply, so we should expect the same sort of shortages they experience in Great Britain's National Health Service. On the issue of government intervention in the health care industry, I highly recommend Colin Gunn's film Wait Till Its Free.

Saturday, October 10, 2015

The Moral Basis of Economics vs. Socialism

That is the topic I discussed with Dan Elmendorf during my most recent appearance on A Plain Answer, a weekly program broadcast on the Redeemer Broadcasting Network.

That is the topic I discussed with Dan Elmendorf during my most recent appearance on A Plain Answer, a weekly program broadcast on the Redeemer Broadcasting Network.We talked about the Christian ethic of private property and what that ethic implies for economic policy. We also talked about the economic benefits of a free market and why socialism always fails. You can access a podcast of the program by clicking here.

Tuesday, October 6, 2015

Mises Was Right!

About socialism, says Andrea Rondón García, director of CEDICE’s Property Rights Committee, and academic

director of the Ludwig Von Mises Institute in Venezuela. She also teaches at the Andrés Bello Catholic University.

In a recent column, Garcia explains Venezuela's socialist disaster She cites Ludwig von Mises as she notes how socialism breeds economic regression, poverty, and political and civil repression as well:

In a recent column, Garcia explains Venezuela's socialist disaster She cites Ludwig von Mises as she notes how socialism breeds economic regression, poverty, and political and civil repression as well:

Since 2003, the Venezuelan government has pushed central-economic planning as its fundamental policy: Chavistas have imposed price and exchange controls, ignored property rights, expropriated businesses, and destroyed the private sector’s productive capacity.

When economic liberties are compromised, political and civil liberties go with them. The blatant threat against César Miguel Rondón demonstrates how low the government has sunk in its attack on freedom of speech.

Wednesday, September 16, 2015

Herbener on Welfare Economics

. . . .on the Tom Woods Show. Grove City College Economics Department Chairman, Jeffrey Herbener was interviewed by Tom Woods about welfare economics, sound and unsound. He explains the nature of the claim that a free market maximizes social welfare and what economists can say and importantly what they cannot say about these matters. Grove City College economics students are blessed with this level of education every day.

Sunday, September 6, 2015

Government Subsidies to Students Drive Up College Tuition

Awhile ago someone pointed me to a meme somebody else made with my photo. Although I did not say what was included as the caption, I generally agree with the sentiment. Mundane economics indicates that when the government subsidizes consumers, they will demand more. Recently William Shuggart explained why it is true that when government money is poured into the hands of demanders of higher education, the demand for college increases, resulting in higher tuition. A recent study by the New York Federal Reserve Bank corroborates this principle.

Awhile ago someone pointed me to a meme somebody else made with my photo. Although I did not say what was included as the caption, I generally agree with the sentiment. Mundane economics indicates that when the government subsidizes consumers, they will demand more. Recently William Shuggart explained why it is true that when government money is poured into the hands of demanders of higher education, the demand for college increases, resulting in higher tuition. A recent study by the New York Federal Reserve Bank corroborates this principle.

Friday, September 4, 2015

Now Available for Kindle

For those who like their economics to come to them electronically, Foundations of Economics: A Christian View is now available for Kindle. And at about one forth the paperback price. I personally prefer the look and feel of fine, hand-tooled paper (I'll let those who went to high school in the eighties see if they can decipher that allusion).

For those who like their economics to come to them electronically, Foundations of Economics: A Christian View is now available for Kindle. And at about one forth the paperback price. I personally prefer the look and feel of fine, hand-tooled paper (I'll let those who went to high school in the eighties see if they can decipher that allusion). Wednesday, August 5, 2015

The Importance of Economic Freedom in Light of the Cutlural Mandate

I am blessed to be asked to speak at the upcoming Christians for Liberty Conference, which will be held this Friday and Saturday in Austin, Texas. It is organized and facilitated by Libertarian Christians, headed by Norman Horn.

I will be speaking on a key theme to my book, Foundations of Economics: A Christian View. My talk is entitled "The Importance of Economic Freedom in Light of the Cultural Mandate" and will focus on exactly what the title implies. I explain important economic principles related to economic development related to the cultural mandate and then demonstrate why private property is crucial for such development to occur. I am honored to appear with such high caliber people such as Lawrence Reed, Doug Bandow, Laurence Vance, and Colin Gunn.

There is still time to register here.

I will be speaking on a key theme to my book, Foundations of Economics: A Christian View. My talk is entitled "The Importance of Economic Freedom in Light of the Cultural Mandate" and will focus on exactly what the title implies. I explain important economic principles related to economic development related to the cultural mandate and then demonstrate why private property is crucial for such development to occur. I am honored to appear with such high caliber people such as Lawrence Reed, Doug Bandow, Laurence Vance, and Colin Gunn.

There is still time to register here.

Saturday, August 1, 2015

Wait Till It's Free

That is the title of an oustanding new documentary about our current health care system produced and directed by Colin Gunn. I had the pleasure of watching a showing at the State Theater in Modesto, California. It was the kick-off event for this year's Civics Summit at the Institute for Principle Studies. The documentary has very solid content and high production values. Anyone concerned about our health care system as well as positive solutions should watch this film.

Thursday, July 23, 2015

Herbener on the Division of Labor and Social Order

This week the Ludwig von Mises Institute is hosting its Mises University. My department chair, Jeffrey Herbener is one of the faculty for this event. Here is his lecture from Monday on the nature and benefits of the division of labor:

Students at Grove City College get this level of economics every day.

Students at Grove City College get this level of economics every day.

Friday, July 17, 2015

Rothbard University!

I am blessed to be on the faculty of this year's Rothbard University presented by Mises Institute Canada. I am joining Walter Block, Glen Fox, David Howden, David Clement, Pedrag Rajsic, and Pierre Desrochers. Yesterday I gave lectures on entrepreneurship and money. Today I provide a lecture an history of thought lecture on the Austrian school of economics and tomorrow I finish up discussing economic development. The entire program is being live streamed. You can access it by clicking here.

I am blessed to be on the faculty of this year's Rothbard University presented by Mises Institute Canada. I am joining Walter Block, Glen Fox, David Howden, David Clement, Pedrag Rajsic, and Pierre Desrochers. Yesterday I gave lectures on entrepreneurship and money. Today I provide a lecture an history of thought lecture on the Austrian school of economics and tomorrow I finish up discussing economic development. The entire program is being live streamed. You can access it by clicking here.Thursday, July 9, 2015

Aquinas on Private Property

My friend Harry Veryser explains in this brief video three reasons Thomas Aquinas thought that private property is a social virtue.

Veryser teaches economics at The University of Detroit - Mercy and is the author of It Didn't Have to Be This Way: Why Boom and Bust Is Unnecessary-and How the Austrian School of Economics Breaks the Cycle.

I also briefly mention Aquinas in my Foundations of Economics: A Christian View when discussing the Christian ethic of property. While it is true that Aristotle's view of private property has been tremendously influential, I would also argue that we can trace the idea back farther to at least the book of Exodus.

Veryser teaches economics at The University of Detroit - Mercy and is the author of It Didn't Have to Be This Way: Why Boom and Bust Is Unnecessary-and How the Austrian School of Economics Breaks the Cycle.

I also briefly mention Aquinas in my Foundations of Economics: A Christian View when discussing the Christian ethic of property. While it is true that Aristotle's view of private property has been tremendously influential, I would also argue that we can trace the idea back farther to at least the book of Exodus.

Friday, July 3, 2015

IPS Civics Summitt: Critical Condition

If you are going to be in the Modesto, California area the last weekend in July, you will not want to miss this year's Civics Summit hosted by the Institute for Principle Studies. The theme for this year is as timely as today's headlines: our health care mess.

I will again be presenting lectures, speaking about the Biblical foundations of economics, the economics of the third party payer systems, why middle-of-the-road policy so often leads to socialism, and why health care is so expensive. For more information and to register click here.

We know that healthcare is expensive, and it affects us all on a daily basis. In fact, despite major attempts to reduce costs, the United States has some of the highest healthcare costs in the world. The real question is: why? A thorough study of both economics and biblical principles can give us insight into why current policies are not working, and what better alternatives exist.

Wednesday, July 1, 2015

Another Reason To Be Happy Hamilton Is Leaving the Ten Dollar Bill

When the Federal Reserve System Chairman who helped convince the intelligentsia that the only thing we have to fear is deflation itself and gave us quantitative easing for who knows how long

says he is "appalled" at the prospect of Hamilton's portrait leaving the ten dollar bill.

In a reversal of the old Debbie Boone line, it must be right if Bernanke feels it is so wrong. Bernanke's case for Hamilton is a list of how Hamilton worked to bring more of the economy under the sphere of the state and its central bank. That has not worked out so well.

says he is "appalled" at the prospect of Hamilton's portrait leaving the ten dollar bill.

In a reversal of the old Debbie Boone line, it must be right if Bernanke feels it is so wrong. Bernanke's case for Hamilton is a list of how Hamilton worked to bring more of the economy under the sphere of the state and its central bank. That has not worked out so well.

Sunday, June 28, 2015

Is Private Propety Biblical?

Anne Bradley of the Institute for Faith, Work, and Economics explains why the answer is yes.

Bradley cites various Scriptural passages and our theological tradition. She also points us to a better understanding of social justice. I have also written on this issue in my book Foundations of Economics: A Christian View and in an article, "The Scriptural Case for Private Property and a Free Economy" in the Aeropagus Journal.

Bradley cites various Scriptural passages and our theological tradition. She also points us to a better understanding of social justice. I have also written on this issue in my book Foundations of Economics: A Christian View and in an article, "The Scriptural Case for Private Property and a Free Economy" in the Aeropagus Journal.

Friday, June 26, 2015

Fixing Problems Requires Understanding Them

Dambisa Moyo thinks that one of the problems of the economics profession is that we spend too much fighting and not enough time actually fixing problems, especially regarding poverty and economic development. Her solution is to put down ideology and pragmatically embrace the virtues of any and all systems of economic thought.

Dambisa Moyo thinks that one of the problems of the economics profession is that we spend too much fighting and not enough time actually fixing problems, especially regarding poverty and economic development. Her solution is to put down ideology and pragmatically embrace the virtues of any and all systems of economic thought.She uses the competing ideas of Hayek and Keynes as a framework through which to illustrate her point. He perspective is demonstrated by the pragmatism she thinks we need:

A balanced economic approach that draws on the Hayekian incentive-based prescriptions, but also recognizes the critical role of strong central governments to act effectively in times of crisis, their role in boosting aggregate demand, putting to work underutilized resources and clearing markets when they won’t clear themselves.

While Moyo's goals are laudible--economics serves people as it provides them guidance for ameliorating economic problems--her prescription will achieve her ends only if both Keynesian and Austrian theory are relevant and applicable in different circumstances. There a plenty of reasons to question the soundness of Keynesian theory and the success of Keynesian economic policy. It may very well be that we need to fight the intellectual battles to discover and establish true theory, so we can then rightly apply it in economic policy. Formulating economic policy based on bad economic theory is a recipe for doing more harm than good.

Wednesday, June 24, 2015

Supreme Court Finds in Favor of Private Property?

As hard as it is to believe, that seems to be the case. Such a ruling is something to celebrate on our upcoming Independence Day. This Monday the Supreme Court ruled that a government program meant to increase raisin prices by keeping some of them off the market amounted to an unconstitutional taking of private

property by the government. Let us hope that ruling may be used as a precedent spawning further rulings identifying that other federal regulations that constrain entrepreneurs from using their factors of production as they see fit is also unconstitutional. Not only do such regulations violate the Christian ethic of private property and makes us relatively impoverished by hampering the market division of labor.

As hard as it is to believe, that seems to be the case. Such a ruling is something to celebrate on our upcoming Independence Day. This Monday the Supreme Court ruled that a government program meant to increase raisin prices by keeping some of them off the market amounted to an unconstitutional taking of private

property by the government. Let us hope that ruling may be used as a precedent spawning further rulings identifying that other federal regulations that constrain entrepreneurs from using their factors of production as they see fit is also unconstitutional. Not only do such regulations violate the Christian ethic of private property and makes us relatively impoverished by hampering the market division of labor.

Sunday, June 21, 2015

What Is Economic Freedom and Why Should We Care?

Anne Bradley from the Institute for Faith, Work, and Economics explains why.

The short answer is that it enables human flourishing. For a more in-depth exploration of the topic, see Bradley's paper, "Five Reasons Christians Should Embrace Economic Freedom."

The short answer is that it enables human flourishing. For a more in-depth exploration of the topic, see Bradley's paper, "Five Reasons Christians Should Embrace Economic Freedom."

Friday, June 19, 2015

Economic Wisdom on Renewable Fuel Standards

From Timothy Terrell posting at the Corwall Alliance. Terrel comes to the issue of government mandated renewable fuel standards from the same framework I use in my book, Foundations of Economics: A Christian View, and I expressed in my most recent op-ed about EPA Clean Energy Plan. Economics recognizes that prices are indications of relative scarcity. Therefore, when entrepreneurs arrange production according to profit and loss, they most strictly economize resources that are higher priced. Forcing the move to higher-priced alternatives make no economic sense for entrepreneurs seeking to reap profits. Importantly, they also make no sense for a society seeking to enjoy sustainable economic development. Terrell notes that such mandates make for bad stewardship.

From Timothy Terrell posting at the Corwall Alliance. Terrel comes to the issue of government mandated renewable fuel standards from the same framework I use in my book, Foundations of Economics: A Christian View, and I expressed in my most recent op-ed about EPA Clean Energy Plan. Economics recognizes that prices are indications of relative scarcity. Therefore, when entrepreneurs arrange production according to profit and loss, they most strictly economize resources that are higher priced. Forcing the move to higher-priced alternatives make no economic sense for entrepreneurs seeking to reap profits. Importantly, they also make no sense for a society seeking to enjoy sustainable economic development. Terrell notes that such mandates make for bad stewardship.As he explains,

Trying to force the adoption of another energy source, whether that is ethanol, wind energy, solar, or something else, means spending something valuable to conserve something cheap. Using “renewable” ethanol means using valuable farmland, water for irrigation, fertilizer (some of which is petroleum derived), tractors and tractor fuel for planting and harvesting, trucks for transportation of corn, fuel and water for distillation plants, and human labor. Cheaper energy sources are right under our noses.

But using ethanol means we’ll have more oil to use later, right? Yes. It means that we’ll use up the existing petroleum reserves at a somewhat slower rate, and will shift to other energy sources a little later. But it also means sacrificing all those valuable resources in the present—all the food that could have been grown on the farmland, all the water which could have irrigated other crops or increased stream flow for fishing and recreation, all the tractors and other vehicles, and the rest. It means, in short, less economic development now. It is economic development that gives us the tools to extract oil from harder-to-reach places, gives us innovations that increase the efficiency with which we use oil, and which will eventually replace petroleum. And it is economic development that saves lives. It is economic development from lower-cost energy today that reduces infant mortality and other causes of death, so that children have the chance to grow up, get an education, and become the innovators of the future.

Sunday, June 14, 2015

A Biblical Case for Economic Freedom

Anne Bradley of the Institute for Faith, Work, and Economics thinks there is one. Here is the introduction to a lecture she gave at Grove City College.

She highlights the importance for economic freedom and ameliorating poverty. That was also one of the conclusions of Francis Wayland. I encourage those interested in thinking about economics and how to help the poor to take a look at the book For the Least of These.

She highlights the importance for economic freedom and ameliorating poverty. That was also one of the conclusions of Francis Wayland. I encourage those interested in thinking about economics and how to help the poor to take a look at the book For the Least of These.

Saturday, June 13, 2015

Jonathan Nelson on Another Fascist Assault on Economic Freedom

Thomas Sowell, along with many others, has noted the inherently fascist nature of President Obama's economic policy. His administration and his helpers in Congress have been grabbing more and more control over larger and larger parts of our economy, all the while leaving nominal ownership of property in private hands.

Grove City College economics major Jonathan Nelson has just had a piece published that documents another attempt to force people to change the way they live according to the wishes of the President. His essay, "Uncle Sam's Assault on the Suburbs" Nelson explains the government's actions attempt to "force families into densely-populated housing, including a reliance on public transportation instead of individual automobiles" by HUD's implementation of the "Affirmatively Furthering Fair Housing (AFFH)" rule. Nelson notes that, not only will the rule have negative economic consequences, not surprisingly, such aggression flies in the face of the Constitution.

Of course,we've been treating the Constitution with fascist-like tendencies for a long time now: Citizens have certain rights on paper, but in practice that state does whatever it wants.

Grove City College economics major Jonathan Nelson has just had a piece published that documents another attempt to force people to change the way they live according to the wishes of the President. His essay, "Uncle Sam's Assault on the Suburbs" Nelson explains the government's actions attempt to "force families into densely-populated housing, including a reliance on public transportation instead of individual automobiles" by HUD's implementation of the "Affirmatively Furthering Fair Housing (AFFH)" rule. Nelson notes that, not only will the rule have negative economic consequences, not surprisingly, such aggression flies in the face of the Constitution.

Not only does the proposed rule threaten the existence of some suburban neighborhoods, it abandons a core principle of our Constitution: federalism. If implemented, the AFFH rule would allow HUD, a federal agency, to override the zoning power of local governments. Without the ability for local and state governments to make their own sovereign decisions, the balancing power of federalism is lost.

Of course,we've been treating the Constitution with fascist-like tendencies for a long time now: Citizens have certain rights on paper, but in practice that state does whatever it wants.

Friday, June 12, 2015

David Howden Answers Critics of Austrian Business Cycle Theory

On the Tom Woods Show. Howden responds especially to claims that Mises and Rothbard were inconsistent when claiming that unemployment is do to real wages above the market wage and yet refusing to accept monetary inflation to remedy such situations. He also ably defends Austrian Business Cycle Theory (ABCT) against claims that the theory depends on irrational expectations.

David Howden is chairman of the department of business and economics at the Madrid campus of St. Louis University. He is academic vice president of Mises Canada, editor of the journal Prices & Markets, and co-editor of The Fed at One Hundred, to which I contributed a chapter.

This episode is also relevant for readers of my book, Foundations of Economics: A Christian View, because I use ABCT to explain recessions in the chapters covering macroeconomic theory and policy.

David Howden is chairman of the department of business and economics at the Madrid campus of St. Louis University. He is academic vice president of Mises Canada, editor of the journal Prices & Markets, and co-editor of The Fed at One Hundred, to which I contributed a chapter.

This episode is also relevant for readers of my book, Foundations of Economics: A Christian View, because I use ABCT to explain recessions in the chapters covering macroeconomic theory and policy.

Saturday, June 6, 2015

Whither the Population Bomb?

Fascinating retrospective of "The Unrealized Horrors of the Population Bomb" at the New York Times.

The money quote from Gita Sen, development economist at the Centre for Public Policy, Indian Institute for Management in Bangalore:

The money quote from Gita Sen, development economist at the Centre for Public Policy, Indian Institute for Management in Bangalore:

"I know Paul Ehrlich reasonably well and I respect him as a biologist. I don't and never have, and he knows it, agree with his views on population. It's a tendency to apply to human beings the same sort of models that may apply for the insect world. The difference, of course, is that human beings are conscious beings and we do all kinds of things to change our destiny."

Friday, June 5, 2015

Here's How We Can Stop the EPA's War on the Poor

In his State of the Union Address, President Barack Obama promoted his vision of "middle-class economics."

In his State of the Union Address, President Barack Obama promoted his vision of "middle-class economics."Alas, what his budget proposal pledged to giveth, his energy policy taketh away. The industry regulations pushed by Obama's Environmental Protection Agency, conflict with his stated budget intentions by foisting higher household energy costs that fall disproportionately on the poorest among us.

In a free market, entrepreneurs serve society tremendously by coordinating the entire market division of labor, directing scarce resources toward their most highly valued use as determined by members of society.

The price system ensures that those who produce the most demanded goods in the most efficient way will reap profits, while those who fail to do so will reap losses.

Business regulations serve to hamper this beneficent market process. Regardless of any other purposes they serve, regulations constrain entrepreneurs from arranging production processes in their best, most efficient pattern.

They necessarily increase costs of

production and decrease the quantity of products people have available

to satisfy their ends. In short, business regulation results in relative

impoverishment.

Saturday, May 30, 2015

Minimum Wage for Thee, but Not for Me

It has been reported that the president of the L.A. Federation of Labor, Rusty Hicks, made a last minute plea to the Los Angeles City Council, to allow any company that unionizes to be exempt from the city's new minimum wage law that mandates an increase to $15/hr. by 2020. This is the very minimum wage law they helped to pass. It seems that union leaders recognize economic law after all. I explain the economics of the minimum wage in my book, Foundations of Economics: A Christian View. My summary of the effects of the minimum wage are as follows:

I also argue that minimum wage laws violate Christian ethics:

This is not the first time an organization lobbying for the minimum wage requested to be exempt from it. In 1995 ACORN sued sued the state of California for exemption from paying the minimum wage to its own employees. ACORN argued before the court that "The more that ACORN must pay each individual outreach worker—either because of minimum wage or overtime requirements—the fewer outreach workers it will be able to hire."

At best it benefits some workers at the expense of other workers. Some lower-skilled workers will get paid more, while the lowest-skilled workers are left unemployed. Even higher-skilled workers can benefit from effective minimum wages, however. Unionized forklift operators, for example, benefit when stock boys are kept out of work because of above-market minimum wages. Those who are kept out of a job earn lower incomes over time because it takes them longer to develop job skills. Society in general is worse off because they have fewer goods available for which they must pay higher prices. Once again, the result of government intervention is exactly the opposite of what proponents of such intervention say they intend. An effective minimum wage does not reduce poverty. Rather, it places obstacles in the path of lower skilled workers in their quest to improve their lot in life.

I also argue that minimum wage laws violate Christian ethics:

Minimum wage laws prohibit some workers and entrepreneurs from making mutually beneficial work agreements. Some workers, who are not productive enough to warrant employment at the artificially high wage, are prohibited from exchanging their labor as they see fit. Some workers benefit at the expense of the least productive. Because price controls violate the Christian ethic of private property, they must be rejected as a means of achieving a better society.

The Christian property ethic does not allow for using the power of the state to keep people from entering into voluntary contracts. Christians are called to be charitable to those who need it and to be merciful to the poor and to see that widows and orphans are not oppressed. Justice demands, however, that people use their own resources to help those in need and to convince others voluntarily to do so. Lobbying for government price controls violates the right to property and therefore violates the Christian ethic.

This is not the first time an organization lobbying for the minimum wage requested to be exempt from it. In 1995 ACORN sued sued the state of California for exemption from paying the minimum wage to its own employees. ACORN argued before the court that "The more that ACORN must pay each individual outreach worker—either because of minimum wage or overtime requirements—the fewer outreach workers it will be able to hire."

Monday, May 25, 2015

Jeff Herbener on Microeconomics on the Tom Woods Show

A week and a half ago, my friend and department chair, Jeffrey Herbener, is the guest on The Tom Woods Show. In this program, he responds to criticisms of Austrian economics and particularly microeconomic analysis, largely based on Bryan Caplan's article "Why I am not an Austrian economist." In this interview, Herbener elucidates some of what sets Grove City College's economics department apart from others. It is well worth your time.

Tuesday, April 28, 2015

The Federal Reserve: Economics and Ethics

I was again blessed to be a guest of Dan Elmendorf on his radio program A Plain Answer, a program produced and broadcast on the radio stations in the Redeemer Broadcasting

network. In this interview we discuss the nature and history of the Federal Reserve System. I also talk about the economics and ethics of central banking and government money production. I thought my exposition a little choppy, but not incoherent. My goal was to introduce the topic of the Federal Reserve to interested parties who perhaps have little knowledge of our central money making machine. You can imagine how broad brush I needed to paint in twenty-seven minutes. In any event, you can hear how I did by clicking here.

I was again blessed to be a guest of Dan Elmendorf on his radio program A Plain Answer, a program produced and broadcast on the radio stations in the Redeemer Broadcasting

network. In this interview we discuss the nature and history of the Federal Reserve System. I also talk about the economics and ethics of central banking and government money production. I thought my exposition a little choppy, but not incoherent. My goal was to introduce the topic of the Federal Reserve to interested parties who perhaps have little knowledge of our central money making machine. You can imagine how broad brush I needed to paint in twenty-seven minutes. In any event, you can hear how I did by clicking here.

Tuesday, April 7, 2015

Myths about the Gender Wage Gap

Abigail Hail has a helpful post on The Beacon, the blog for the Independent Institute about the alleged gender wage gap, what she calls "a myth that just won't die." She rightly calls us to get the analysis straight before making political hay from a pet statistic that does not tell the whole story. As Hail notes,

She then concludes by noting that a lot of the rhetoric that comes from the advocates of state intervention is rather condescending toward the very ones they claim to help.

I am very happy to see Hail's contribution to the debate, because she affirms many of the points I noted many years ago when I wrote on the same issue. Back in 1999 I came to the same conclusions.

The first thing to notice is that the “77 cents on the dollar” metric isn’t comparing apples to apples. It is a comparison of gross income. That is, it compares the income of all women to that of all men. It fails to take into account important factors—like education, experience, or even just comparing people in the same career. You wouldn’t compare the incomes of elementary school teachers with Bachelor’s degrees to those of individuals with PhDs in physics and complain that there is a “teacher-physicist wage gap” —but this is precisely what this statistic does.

When you take these characteristics into account, the purported “gap” all but disappears.

She then concludes by noting that a lot of the rhetoric that comes from the advocates of state intervention is rather condescending toward the very ones they claim to help.

Now, some will point to the statistics on the careers men and women tend to choose and say that women aren’t really “free” to choose their careers. This is not only incredibly patronizing, but ignores the fact that women in the U.S. are not only well educated, but also well-informed when it comes to selecting our careers. It’s not as if women are unaware that social workers and schoolteachers tend to earn less than engineers. We choose careers just as men do. We consider what we think is most important when selecting a career, look at our options, and make the best choices we can.

When it comes to issues of gender equality, there are a variety of issues to discuss. When having these discussions, however, it’s important for women and men to discuss the facts and present correct information. Otherwise, we not only perpetuate incorrect information, but we ultimately fail to advance these issues in any meaningful way.

All of this demonstrates that the performance of women's earnings over time is not the result of systematic discrimination. Whether egalitarians like it or not, for the "average" woman family life trumps other concerns on the margin. Employers and employees are merely recognizing this fact of nature: women and men are not equal in the sense of being identical. They are different and have different comparative advantages when it comes to work outside the home versus child rearing.

Of course, both men and women would like to work for much more than what they are getting paid, other things equal. But then, the other things are never equal. That fact serves as a useful device for egalitarian politicians and bureaucrats. Social engineers use the persistence of inequality of income as the warrant for never-ending regulation.

Monday, March 30, 2015

Bernanke On the Defensive

Perhaps due to essays like mine, Ben Bernanke is on the defensive asserting that the Federal Reserve "didn't throw savers under the bus" as it drove the Federal Funds rate to virtually zero. Bernanke cites unnamed economists who argue that the natural rate of interest has fallen over the past two decades. On the one hand, I suppose we should be thankful that Bernanke recognizes there is something like a natural rate of interest that is not controlled by the Fed. On the other hand, the idea that it is zero seems unlikely. In light of Austrian Business Cycle Theory, it is not true that holding the interest rate artificially low promotes a healthy economy. Here is another example of how Fed rhetoric does not match economic reality, the subject of my contribution to The Fed at One Hundred: A Critical View of the Federal Reserve System.

Tuesday, March 17, 2015

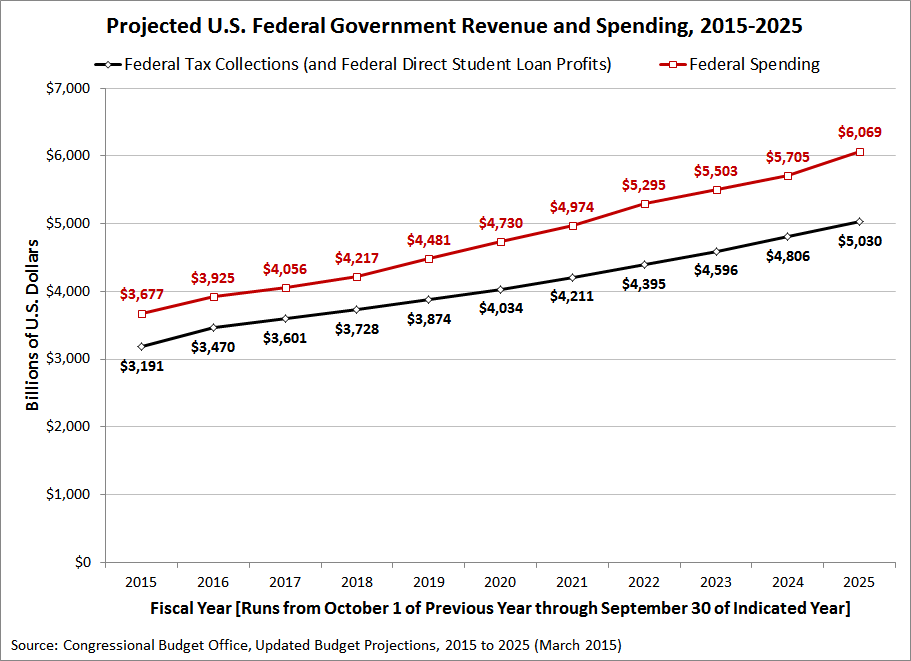

Government Deficits All the Way Up

According the the scientist, it may be turtles all the way down, but with fiscal policy, the Congressional Budget Office informs us that for the next ten years, we can expect budget deficits all the way up.A well-known scientist (some say it was Bertrand Russell) once gave a public lecture on astronomy. He described how the earth orbits around the sun and how the sun, in turn, orbits around the center of a vast collection of stars called our galaxy. At the end of the lecture, a little old lady at the back of the room got up and said: "What you have told us is rubbish. The world is really a flat plate supported on the back of a giant tortoise." The scientist gave a superior smile before replying, "What is the tortoise standing on?" "You're very clever, young man, very clever," said the old lady. "But it's turtles all the way down!" —Stephen Hawking, A Brief History of Time

Notice that the expected gap between spending and revenue widens as the years go by. This does not bode well for our economic future. Government spending is a tax of resources taken out of private hands and consumed by government bureaucrats. Such consumption hampers, not facilitates, economic prosperity.

Friday, March 13, 2015

What Did My Parents Ever Do to the Federal Reserve?

That is the question I am left asking after considering various claims about the supposed worrisome consequences of lower prices. David Blanchflower calls price deflation "a major economic pandemic spreading thoughout the world." Justin Wolpers likewise warns us of deflationary expectations. Financial advisor Bert Whitehead asserts, "we really have a danger of deflation world-wide." The solution for those who share the fear is always the same, create more money, stimulate more spending, and higher prices will follow. Bank of England Governor Mark Carney soothes deflation worries, for example, not by acknowledging that falling prices are not socially harmful, but by assuring us that Europe will get back to price inflation soon.

As I said, after all of this chatter, I am left wondering about the ethics of purposely reducing the purchasing power for those who have worked hard and saved all their lives. Higher prices do not, in fact provide prosperity, but instead result in increasing economic hardship for people like my parents. In my latest column for the Grove City College Center for Vision and Values I conclude:

Read the rest here.

As I said, after all of this chatter, I am left wondering about the ethics of purposely reducing the purchasing power for those who have worked hard and saved all their lives. Higher prices do not, in fact provide prosperity, but instead result in increasing economic hardship for people like my parents. In my latest column for the Grove City College Center for Vision and Values I conclude:

. . .Mom and Dad had the foresight and character to make the sacrifices necessary to stay out of debt. Indeed, they are Paul Krugman’s worst nightmare—a family determined not to live beyond their means. Now retired, like many in their generation they are enjoying life the best they can on an almost fixed income. Because they have no debt, they have been able to live without tremendous economic hardship thus far. The Federal Reserve’s inflationism, however, increasingly makes life for them more difficult as steady price inflation daily chips away at their livelihood. Since 2009, for example, the Consumer Price Index has increased over nine percent. This masks, however, significantly larger price increases for important necessities. Prices of dairy products are up almost 17 percent since 2009. Gasoline prices are up almost 11 percent despite the recent decline. Prices for meat, poultry, fish, and eggs have increased a whopping 26 percent since 2009. Higher overall prices do not help people like my parents at all. They instead act as a thief, snatching wealth away from them in the form of diminished purchasing power. What they long for is to see the value of their savings increase. Far from creating economic hardship for them, lower overall prices would be a boon.

Both sound economics and ethics, therefore, demand that we give up the anti-deflation rhetoric and the inflation it fuels. Charity demands that we cease striking fear into the hearts of the masses, softening them up for ever higher prices. The Federal Reserve should stop punishing people like my parents who have worked hard and played by the rules their whole lives. After all, what did they ever do to Greenspan, Bernanke, and Yellen?

Read the rest here.

Thursday, March 12, 2015

Austrian Economics Research Conference

The AERC began today and so far, so excellent. My colleague, Jeff Herbener and I got here this afternoon just in time to hear David Rapp, Herbener's co-author, deliver their paper and then hear the Henry Hazlitt Lecture by John Tamny. Tamny is the political economy editor at Forbes and editor of RealClearMarkets.com. His lecture, "Government Barriers to Economic Growth: How Policy Error Gave Us the Great Depression, the Financial Crisis, and the Great Recession," was a tremendous, engaging discussion about how the state hinders economic prosperity with applications from the Great Depression, the financial meltdown, and today.

The AERC began today and so far, so excellent. My colleague, Jeff Herbener and I got here this afternoon just in time to hear David Rapp, Herbener's co-author, deliver their paper and then hear the Henry Hazlitt Lecture by John Tamny. Tamny is the political economy editor at Forbes and editor of RealClearMarkets.com. His lecture, "Government Barriers to Economic Growth: How Policy Error Gave Us the Great Depression, the Financial Crisis, and the Great Recession," was a tremendous, engaging discussion about how the state hinders economic prosperity with applications from the Great Depression, the financial meltdown, and today.

Thursday, February 26, 2015

What Is a Free Market?

That is the question, among others, posed to me by Dan Elmendorf on his radio program A Plain Answer. That program is produced and broadcast on the radio stations in the Redeemer Broadcasting network. In the interview I do discuss the economics and morality of the free market, identify the institutions necessary to support such a market, and the consequences when governments interview via a host of measures. My goal was to introduce listeners with perhaps no formal training in economics to sound analysis. You can see if I succeeded by clicking here.

That is the question, among others, posed to me by Dan Elmendorf on his radio program A Plain Answer. That program is produced and broadcast on the radio stations in the Redeemer Broadcasting network. In the interview I do discuss the economics and morality of the free market, identify the institutions necessary to support such a market, and the consequences when governments interview via a host of measures. My goal was to introduce listeners with perhaps no formal training in economics to sound analysis. You can see if I succeeded by clicking here.

Saturday, February 21, 2015

Engelhardt on Monetary Independence

This year's Austrian Student Scholars Conference got off to a vigorous start with Lucas Engelhardt's delivery of the Hans Sennholz memorial lecture. Engelhardt drew upon the work of Sennholz himself to make the case for an entire free market in money and banking. He explained what he sees as the problems of our current monetary regime as well as the limitations of various monetary rules that have been proposed by economists such as Milton Friedman, John Taylor, and Scott Sumner.

This year's Austrian Student Scholars Conference got off to a vigorous start with Lucas Engelhardt's delivery of the Hans Sennholz memorial lecture. Engelhardt drew upon the work of Sennholz himself to make the case for an entire free market in money and banking. He explained what he sees as the problems of our current monetary regime as well as the limitations of various monetary rules that have been proposed by economists such as Milton Friedman, John Taylor, and Scott Sumner.He then made the case for the benefits and viability of a completely free market for money and banking in which anyone could attempt to produce and circulate money. He explained how such a system could work like the market for any other economic good. He then outlined a few steps that would take us in that direction, such as abolishing legal tender laws, taking government monetary titles off of metallic currency, and allow for freedom in the banking industry. All in all, it was a tremendous beginning to what promises to be an outstanding conference.

Part way through Engelhardt's lecture, it occurred to me that this years ASSC features three generations of Austrian economists. Tonight's Sennholz Lecture was given by a former student of mine. Tomorrow's Ludwig von Mises Memorial Lecture will be delivered by a professor I had in graduate school, Mark Thornton. What a blessing to see how economic truth has been communicated from one generation to the next.

Thursday, February 19, 2015

Austrian Student Scholars Conference 2015

Tomorrow begins this years Austian Student Scholars Conference. We will hear twenty-two papers presented by students from the United States as well as abroad. We will also hear keynote lectures by Dr. Lucas Engelhardt and Dr. Mark Thornton. Admission to all lectures and paper presentations are free and open to the public. Below is a schedule of events:

Friday, February 20, 2015

5:00-5:30

Registration. HAL Atrium.

5:30-6:30 Dinner.

SU Great Room.

7:00-8:00

Hans Sennholz Memorial Lecture.

Sticht Lecture Hall.

“A Case for Monetary Independence"

Dr. Lucas Engelhardt

Assistant Professor of

Economics

Kent State University, Stark

Saturday, February 21,

2015

8:30-9:00

Coffee and Pastries. HAL

Atrium.

9:00-10:30

Sessions

▪ Legislating Morality. Chairman: Jeff Herbener.

HAL 114.

Trafficking,”

Jon Nelson (Grove City College)

• “Prohibition,” Brian O’Riordan (Grove City College)

• “What Has Government Done to Marriage,” Ryan Brown (Grove City College)

Claire Vetter

(Grove City College)

10:45-12:15

Sessions

▪ Liberal Social Order. Chairman: Jeff Herbener.

HAL 114.

Zack Yost

(Mercyhurst University)

Kyle Kreider

(Grove City College)

Bloomington

Institutional Analysis,” Chesterton Cobb (Grove City College)

▪ Foundational Issues in Economics. Chairman: Shawn

Ritenour. HAL 116.

Modern Epistemological Theory,” Jake Tinkham (Grove City College)

Xiaolin Zhang

(University of Lethbridge, Canada)

Davis Bourne

(Millsaps College)

Daniel

Sanchez-Piñol Yulee (King Juan Carlos University, Spain)

12:30-1:30

Lunch. SU Great Room.

2:00-3:30

Sessions

▪ Problems in Macroeconomics. Chairman: Jeff Herbener.

HAL 114.

Karl-Friedrich Israel (University of Angers, France)

Economic Slump,” Eric Peterman (Grove City College)

• “Capital Mobility and Comparative Advantage,”

William Casey (Grove City College)

▪ Policy, Ancient and Modern. Chairman: Shawn Ritenour.

HAL 116.

Justin Klazinga

(Grove City College)

Franco Martin Lopez (Universidad Abierta Interamericana, Argentina)

George Lominadze (Ilia State University, Georgia)

3:45-5:15

Sessions

▪ Great Debates in Economics. Chairman: Jeff Herbener.

HAL 114.

Scott Alford (Grove

City College)

Subjective Theories of Value,” Thomas Cottone (Florida Atlantic

University)

in the

Marketplace,” Jared Billings (Grove City College)

▪ Money and Banking. Chairman: Shawn Ritenour.

HAL 116.

Zack Morrow

(Wofford College)

• “Detangling the Fractional Reserve Debate,” Dorian

Rahamin (Vienna, Va.)

• “The Euro, Pros and Cons,” Evan Burns (Grove City College)

5:30-6:30

Dinner. SU Great Room.

6:45-7:00 Awarding of the

Richard E. Fox Prizes for Best Papers.

Sticht Lecture Hall.

7:00-8:00

Ludwig von Mises Memorial Lecture.

Sticht Lecture Hall.

“What a Real Free Market in Drugs Looks Like”

Dr.

Mark Thornton

Wednesday, January 14, 2015

Reality Trumps Federal Reserve Rhetoric

An excerpt from my chapter, "The Fed: Reality Trumps Rhetoric" appears today as a daily article at Mises.org. I was honored to be asked to contribute the chapter to a new book, The Fed at One Hundred that provides a critical assessment of our nation's central money making machine. Edited by David Howden and Joseph T. Salerno, the book is an excellent work providing a scholarly evaluation of the Federal Reserve. In my chapter I explore main themes in the rhetoric used by Fed officials, drawing upon speeches from Federal Reserve Chairmen and official Fed publications since its inception. I then hold this rhetoric up to the light of the monetary and economic history of the United States and show that despite claims to be the savior of the global economy,

An excerpt from my chapter, "The Fed: Reality Trumps Rhetoric" appears today as a daily article at Mises.org. I was honored to be asked to contribute the chapter to a new book, The Fed at One Hundred that provides a critical assessment of our nation's central money making machine. Edited by David Howden and Joseph T. Salerno, the book is an excellent work providing a scholarly evaluation of the Federal Reserve. In my chapter I explore main themes in the rhetoric used by Fed officials, drawing upon speeches from Federal Reserve Chairmen and official Fed publications since its inception. I then hold this rhetoric up to the light of the monetary and economic history of the United States and show that despite claims to be the savior of the global economy,The history of the Fed has been one of monetary inflation, higher overall prices, diminished purchasing power, economic depressions, and lost decades. In 1913 the state sowed the inflationist wind and for a hundred years we have been reaping the economic whirlwind.

Wednesday, January 7, 2015

Salerno on Rothbard's THE MYSTERY OF BANKING

Here is Joseph Salerno's nice introduction of Murray Rothbard's The Mystery of Banking.

I concur that The Mystery of Banking is an excellent introduction to monetary theory, how fractional reserve banking affects the quantity of money and its purchasing power, and the monetary history of the United States. In fact, if you come to Grove City College to study economics, you will use it as the main text in our Money and Banking course.

I concur that The Mystery of Banking is an excellent introduction to monetary theory, how fractional reserve banking affects the quantity of money and its purchasing power, and the monetary history of the United States. In fact, if you come to Grove City College to study economics, you will use it as the main text in our Money and Banking course.

Thursday, January 1, 2015

Ritenour on Holcombe's ADVANCED INTRODUCTION TO AUSTRIAN ECONOMICS

My review of Randall Holcombe's new Advanced Introduction to Austrian Economics has just been published by Libertarian Papers. Holcombe's concise work makes for an excellent way to introduce any friends (or enemies for that matter) who are schooled in the neoclassical economic framework to the more rich, realistic, and therefore relevant economic analysis in the Austrian tradition.

Subscribe to:

Posts (Atom)