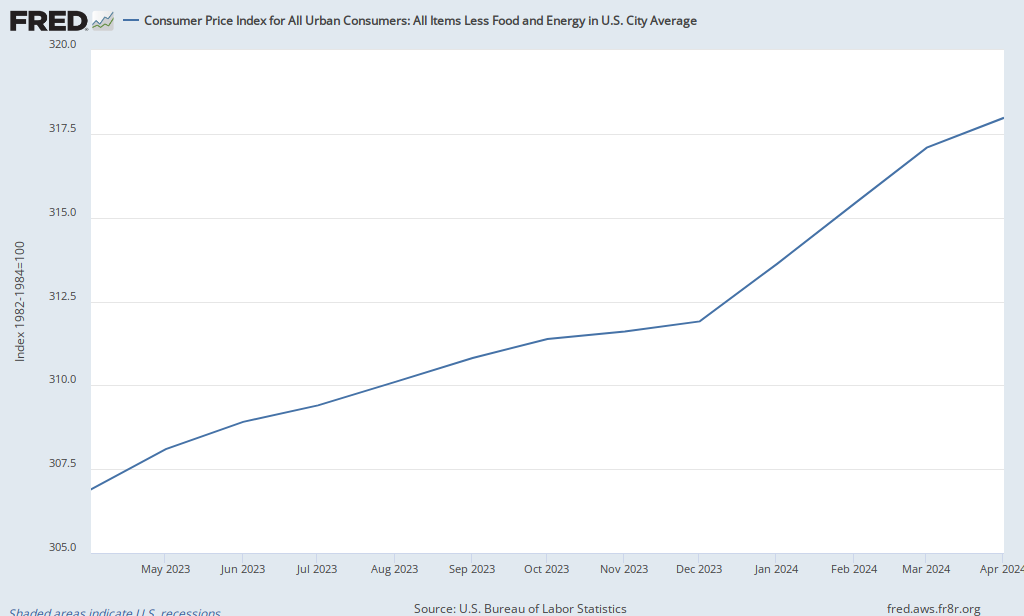

Bloomberg News tells us that history supports Ben Bernanke's practice of focusing on "core inflation" when considering monetary policy. Core inflation is the CPI with energy and food prices removed. The theoretical rationale for this method is that food and energy prices are "volatile" so it is hard to get identify underlying long-term trends when looking at price data that include these sectors.

Over the past year, core inflation looked like this:

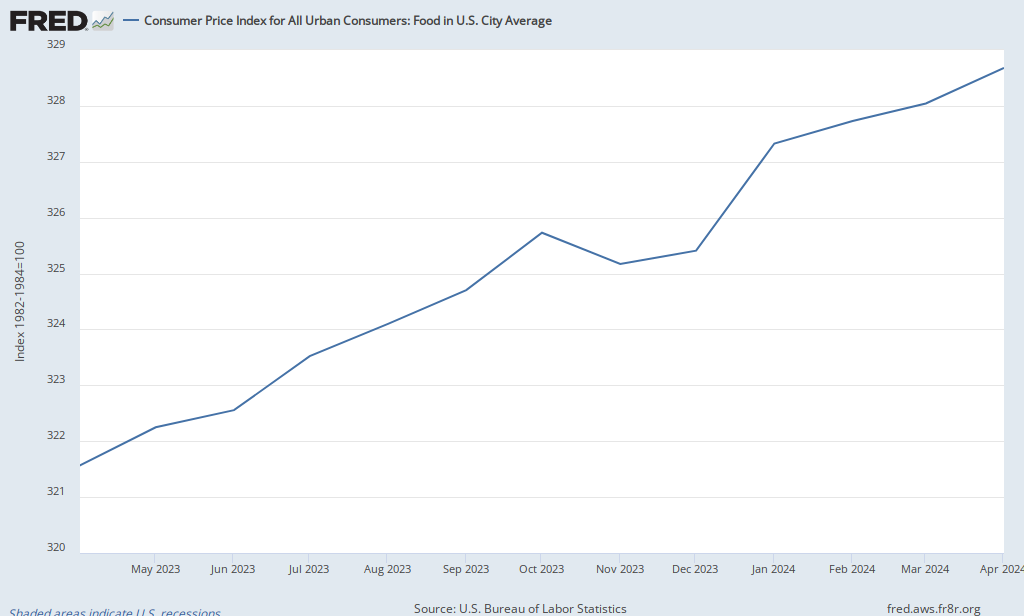

On the other hand, food price inflation looked like this:

And here I thought that volatility meant that prices went up and down.

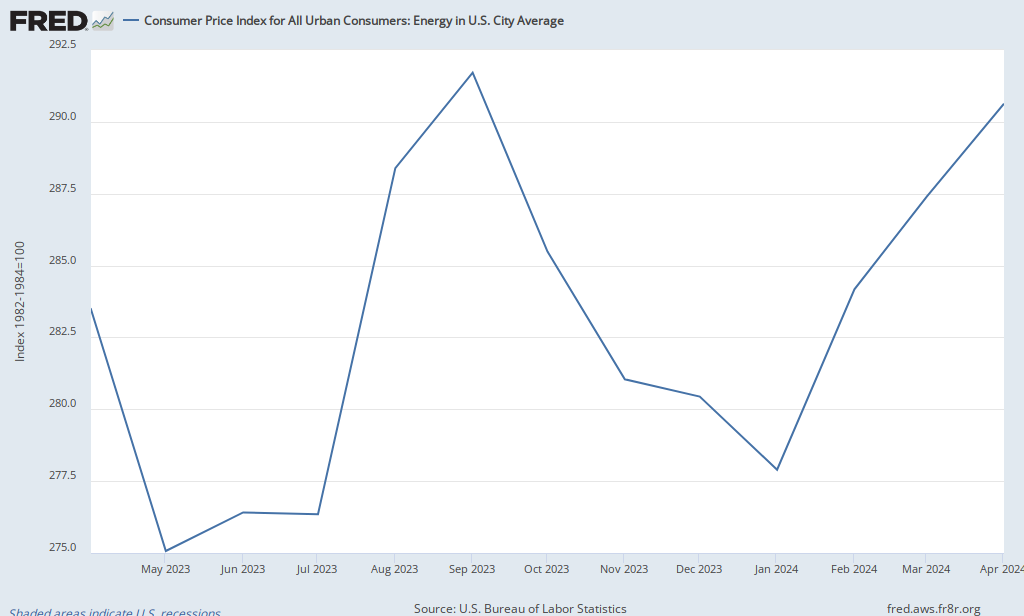

Energy price inflation looked like this:

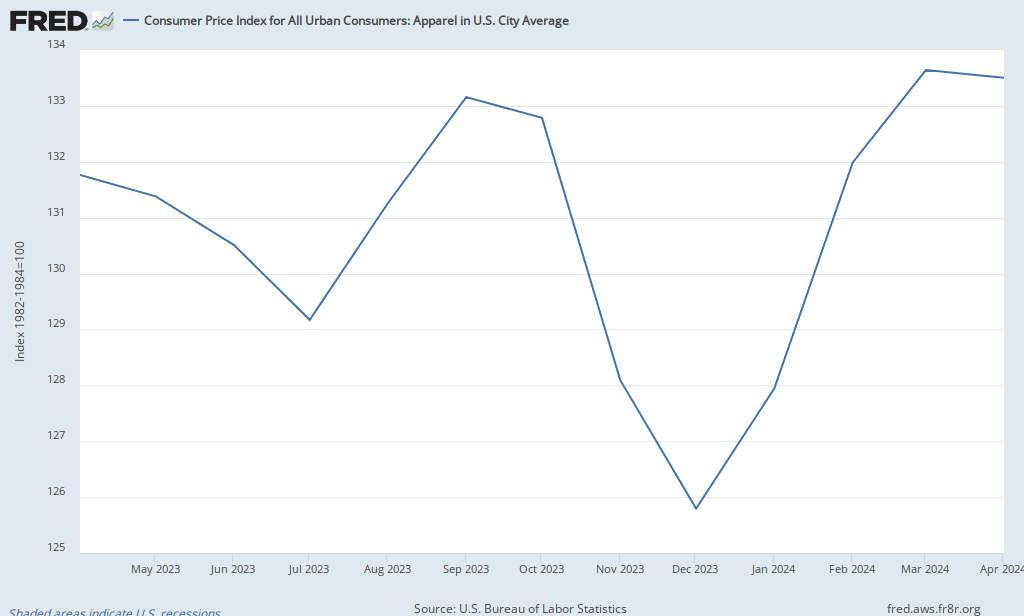

Meanwhile prices of goods that are included in core inflation behaved as follows:

Apparel:

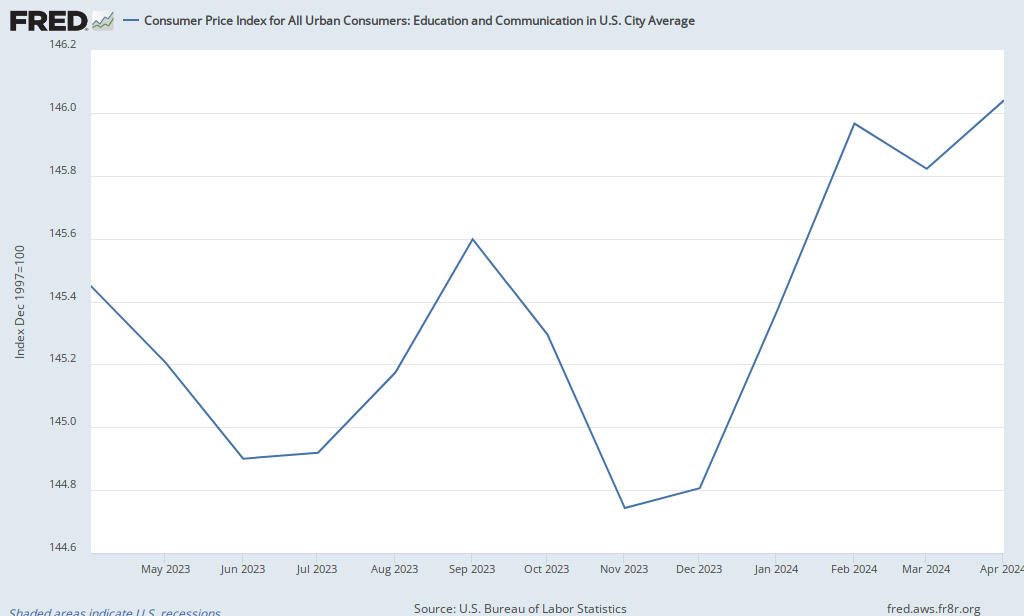

Communication and Education:

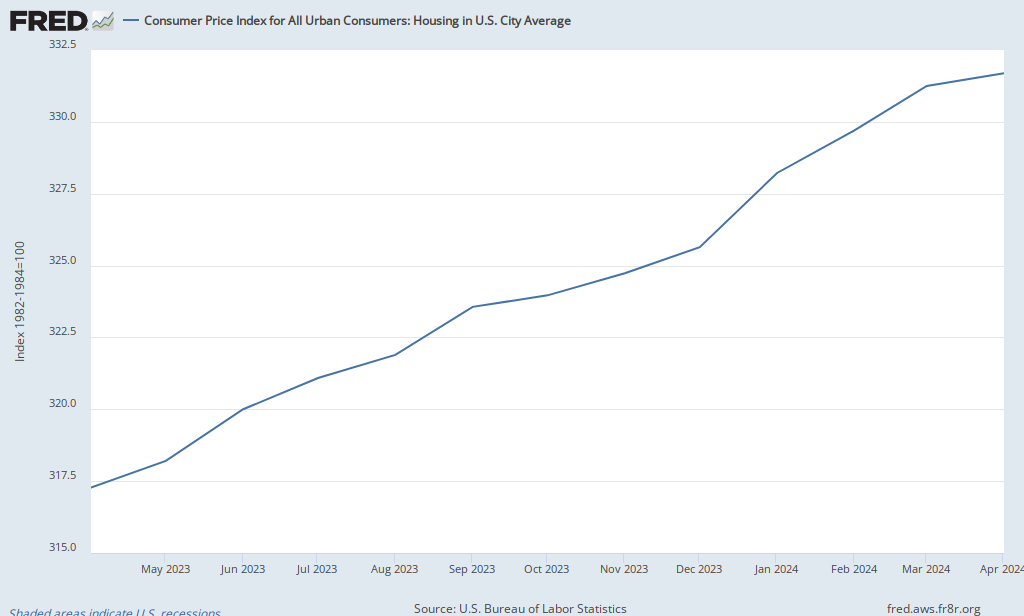

Housing:

On the basis of this data, can we really say that energy and food prices or more volatile than the prices of other sectors included in the core?

No comments:

Post a Comment