|

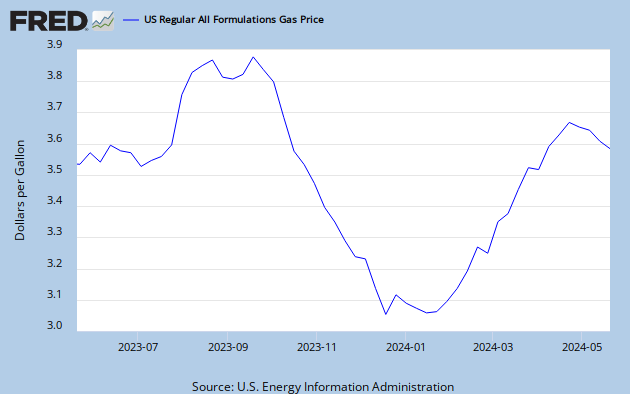

| Gas Prices over the Past Year |

Brandly is responding to comments Fed Chairman Ben Bernanke made at his recent press conference claiming innocence on higher gas prices and to President Obama's targeting oil speculators as the main villains in the higher gas price story. Brandly rightly pinpoints the culpability of monetary inflation instigated by the Fed.

As Brandly explains:

Bernanke's deceitfulness is appalling, although not unexpected. He knows that Federal Reserve monetary policy plays a significant role in gasoline prices. Expansionary monetary policy leads to more dollars being available in world currency markets and weakens the dollar. The weaker dollar results in higher import prices. More than half of the oil consumed in the United States comes from foreign producers, and because oil is the main input needed to produce gasoline, higher oil prices mean higher gasoline prices.

No comments:

Post a Comment