Thursday, September 29, 2011

Ludwig von Mises Day

Today is the 130th anniversary of the birth of Ludwig von Mises, the greatest economist of the Twentieth Century. The Ludwig von Mises Institute has posted Murray Rothbard's excellent biographical sketch, "Ludwig von Mises: Scholar, Creator, Hero" in honor of Mises' birth. I highly recommend it. I also greatly encourage those of you who want to deeply explore the significance of Mises and his work to treat yourself to Jorg Guido Hulsmann's magisterial intellectual biography, Mises: The Last Knight of Liberalism.

Wednesday, September 28, 2011

Mannish on India's Economic Performance from 1951 thorugh 1965

I highly recommend G. P. Mannish's very important article examining India's economic history from 1951 through 1965. Mannish goes behind the GDP numbers to see what was really happening in India's economy during the first three five-year plans after central planning was introduced by the newly independent Indian government. The article is entitled, "Central Economic Planning and India's Economic Performance, 1951-1965" and published in the most recent Independent Review. The abstract reads as follows:

As the abstract implies Mannish shows that, despite impressive looking aggregate statistics, living standards were stagnate. This was primarly due to massive malinvestment on the part of the central planners who wanted to grow via industrialization. Traditionally, India was a highly agrarian economy. The Indian state engaged in three five-year plans to forcibly industrialize the economy. Government planners then channeled investment so as to produce many more of many kinds of capital goods than needed.

The result was a huge amount of industrial over-capacity. There was 65% capacity utilization in capital goods industries in general. Only 27% capacity utilization in the heavy electrical equipment industry, and a measly 16% capacity utilization in mining machinery. Massive quantities of scarce factors of production were squandered producing capital goods that were unneeded and unused. In other words, they were wasted. The consequence of this forced industrialization was a stagnation in the standard of living. Mannish notes with some irony that, "the world’s largest agricultural nation, with nearly three-fourths of its vast population employed in agriculture, had to rely on food-grain imports to raise its level of food-grain availability per capita to minimal nutritional levels."

This paper is a triumph of economic history and well-deserved the Richard E. Fox Third Prize it won at the most recent Austrian Student Scholars Conference here at Grove City College.

Many economists have hailed India’s economic performance under the country’s first three Five-Year Plans, a seeming exception to the rule that central economic planners do more harm than good. However, a close look at the neglected work of father and daughter economists B. R. Shenoy and Sudha Shenoy shows that despite impressive GDP growth, India under central planning suffered from both a stagnation in living standards and a massive malinvestment of resources in heavy industry.

As the abstract implies Mannish shows that, despite impressive looking aggregate statistics, living standards were stagnate. This was primarly due to massive malinvestment on the part of the central planners who wanted to grow via industrialization. Traditionally, India was a highly agrarian economy. The Indian state engaged in three five-year plans to forcibly industrialize the economy. Government planners then channeled investment so as to produce many more of many kinds of capital goods than needed.

The result was a huge amount of industrial over-capacity. There was 65% capacity utilization in capital goods industries in general. Only 27% capacity utilization in the heavy electrical equipment industry, and a measly 16% capacity utilization in mining machinery. Massive quantities of scarce factors of production were squandered producing capital goods that were unneeded and unused. In other words, they were wasted. The consequence of this forced industrialization was a stagnation in the standard of living. Mannish notes with some irony that, "the world’s largest agricultural nation, with nearly three-fourths of its vast population employed in agriculture, had to rely on food-grain imports to raise its level of food-grain availability per capita to minimal nutritional levels."

This paper is a triumph of economic history and well-deserved the Richard E. Fox Third Prize it won at the most recent Austrian Student Scholars Conference here at Grove City College.

Monday, September 26, 2011

Nassau Senior

|

| Nassau Senior (1790 - 1864) |

On this date in 1790, political economist Nassau Senior was born. Senior is identified in a short list of classical economists who adopted a proto-praxeological approach to economic science.

Senior was a second generation classical economist, born the eldest son of a vicar of Durnford, England. He was educated at Eton and Oxford, earning a law degree in 1815. Senior subsequently gained the first endowed chair of political economy at Oxford in 1825. He also worked at various government commissions in 1830s and 40s.

In 1836 he published his great work An Outline of the Science of Political Economy. In this book he criticized the Ricardian economic system while making his main original contributions in the area of economic method and the theory of value and cost.

When discussing the nature of economic inquiry, he argued it was to be essentially positive, not normative. Economics, he thought, is about wealth, not happiness. He writes in the introduction,

[T]he subject treated by the Political Economist, using that term in the limited sense in which we apply it, is not Happiness, but Wealth ; his premises consist of a very few general propositions, the result of observation, or consciousness, and scarcely requiring proof, or even formal statement, which almost every man, as soon as he hears them, admits as familiar to his thoughts, or at least as included in his previous knowledge; and his inferences are nearly as general, and, if he has reasoned correctly, as certain, as his premises. Those which relate to the Nature and the Production of Wealth are universally true ; and though those which relate to the Distribution of Wealth are liable to be affected by the peculiar institutions of particular Countries, in the cases for instance of slavery, legal monopolies, or poor laws, the natural state of things can be laid down as the general rule, and the anomalies produced by particular disturbing causes can be afterwards accounted for. But his conclusions, whatever be their generality and their truth, do not authorize him in adding a single syllable of advice. That privilege belongs to the writer or the statesman who has considered all the causes which may promote or impede the general welfare of those whom he addresses, not to the theorist who has considered only one, though among the most important, of those causes (pp. 2-3).

Also note that, according to Senior economics is to be deductive. Our premises "consist of a very few general propositions" that are self-evidently true. We then apply the laws of deduction to derive true conclusions. This view on economic method is why Senior is often viewed as a proto-praxeologist.

Senior also made contributions to value and cost theory. He advocated a utility theory of value. Relative utility correlated with relative scarcity. The more scarce the good is, the more valuable it is. For Senior, value is that quality which fits goods to be given and received in exchange. He argues that utility is

a necessary constituent of value; no man would give any thing possessing the slightest utility for a thing possessing none; and even an exchange of two useless things would be, on the part of each party to the exchange, an act without a motive. Utility, however, denotes no intrinsic quality in the things which we call useful; it merely expresses their relations to the pains and pleasures of mankind. And, as the susceptibility of pain and pleasure from particular objects is created and modified by causes innumerable, and constantly varying, we find an endless diversity in the relative utility of different objects to different persons, a diversity which is the motive of all exchanges (pp. 6-7).

Note that, according to Senior, utility is not intrinsic, but merely expresses a thing’s relation to pains and pleasures of mankind. Value then is essentially subjective from the point-of-view of the people appropriating goods to satisfy their ends. Not surprisingly, Senior was critical of Ricardo's cost of production theory of value.

Senior also was a proto-Austrian of sorts when it came to capital and interest. He argued that interest was a reward for abstinence, which points to some understanding of time preference. He also hinted that roundabout, more capital intensive, methods of production are more productive than direct methods in the long run.

He was also an early proponent of what we would not call interest group theory. In his work on the Factory Acts he became convinced that they were inspired by the interests of factory operatives who sought to raise their own wages. Such analysis foreshadowed the public choice school of thought.

Sunday, September 25, 2011

The Religious Underpinnings of Economics

Jeffy Bowyer has an insightful little piece at Forbes entitled, "Classical Economics and Its Religious Underpinnings." He cites Jacob Viner's unfinished work The Work of Providence and the Social Order while documenting that classical economists such as Adam Smith and Frederic Bastiat embraced a belief in "optimistic providentialism." Bowyer notes that Bastiat argued "that peaceful labor and abundance was the Edenic intention, but

that there had arisen a 'misunderstanding between God and mankind,' in

which the latter chose the path of coercion."

As Bowyer puts it,

This is very similar to what I argue in the opening chapter of my Foundations of Economics. I draw upon the epistemology of Gordon H. Clark when noting that we only have the ability to know anything because God fit us with certain mental categories as part of being made in His image. At the same time, these mental categories are compatible and harmonize with the rest of the created order because they were all made by the same Creator.

Similarly, economic laws are not merely ephemeral behavior patters that could change on a whim. They are social regularities that necessarily derive from our nature as rational actors, a nature put in place when God made us. Economic laws, therefore, are part of the created order. Not only should we have confidence in such law, we seek to violate it at our peril. Our economic experience since 2006 testifies to that.

As Bowyer puts it,

The idea of providential abundance was extremely important to the defense of the market order. God made a world which is fit for us, and He made us fit for the world. Resources are abundant and responsive to our touch. To use a modern analogy, commerce and technology work so well because we run on the same software, the mind of God. Man and nature are, therefore, compatible because we have the same designer.

Similarly, economic laws are not merely ephemeral behavior patters that could change on a whim. They are social regularities that necessarily derive from our nature as rational actors, a nature put in place when God made us. Economic laws, therefore, are part of the created order. Not only should we have confidence in such law, we seek to violate it at our peril. Our economic experience since 2006 testifies to that.

Saturday, September 24, 2011

Universal Health Care Requires Rationing

In order to be sustainable, that is. That is the conclusion of my colleague Tracy Miller. In an excellent piece of analysis, Miller notes that

Miller goes on to note that if Obamacare is expanded to full universal care, like many desire, costs would escalate to such an extent that we could face a government debt problem similar to that of Greece. Not a very happy prospect.

those who support “universal health care” without also recognizing the need to use some method to ration health care are living in a dream world. In practice, universal health care requires that no one is denied access to basic health care because of an inability to pay the cost; prices will not be used to ration care. Because health care is a scarce good, some other rationing criterion must be used instead of prices. In some countries, such as the United Kingdom, health care is rationed by having people wait their turns, with the result that some illnesses become untreatable before the patient can get the necessary treatment. For example, because of delays for colon cancer treatment in Britain, 20 percent of the cases considered curable at the time of diagnosis become incurable by the time of treatment.

Friday, September 23, 2011

Twisted, That's What You Are

The latest shoe to fall in the effort to appear like he's doing something to help the economic is Ben Bernanke's plan Operation Twist. It is a policy last tried by the Fed in the 1960s and is actually named for the Chubby Checker hit record. The Fed is basically re-balancing their portfolio to buy longer-term bonds with earnings from selling short-term bonds. The goal, ostensibly, is to lower long-term interest rates so as to encourage borrowing, thereby stimulating credit markets.

The latest shoe to fall in the effort to appear like he's doing something to help the economic is Ben Bernanke's plan Operation Twist. It is a policy last tried by the Fed in the 1960s and is actually named for the Chubby Checker hit record. The Fed is basically re-balancing their portfolio to buy longer-term bonds with earnings from selling short-term bonds. The goal, ostensibly, is to lower long-term interest rates so as to encourage borrowing, thereby stimulating credit markets.It will not have much effect on the money supply, because what the Fed giveth in open market purchases of long-term debt, it taketh away by open market sales of short-term debt. It literally only changes the types of assets held by the Fed. It does not alter the quantity.

Given that it will not actually affect the money supply, why would the Fed be doing this. On NPR this morning, an analyst said that it might help some people on the margins borrow money to finance a house. This is needed because evidently a 4.09% interest rate on a 30 year fixed mortgage is just too high. The analyst, recognizing the unlikely event that the plan will result in droves buying homes with newly borrowed money, said that it might help a few people move into larger homes that they could now afford with lower interest rates. And isn't that what we exactly what we need?!?. In a society drowning in debt, isn't the very best thing we can do is to encourage those on the margins to borrow even more money to get into a larger house? Are you kidding me?!?!

I think that the plan is a demonstration that Bernanke is grasping at straws. He recognizes that with short-term interest rates at or near zero, the only thing he has left is to try is to push already historically low long-term interest rates even lower. How's that malinvestment thing in short-term capital markets working out for you? Really, well lets do the same thing for long-term capital.

It's twisted. That's what it is. Forget Cubby Checker. Where's Stan Ridgway when you need him?

Thursday, September 22, 2011

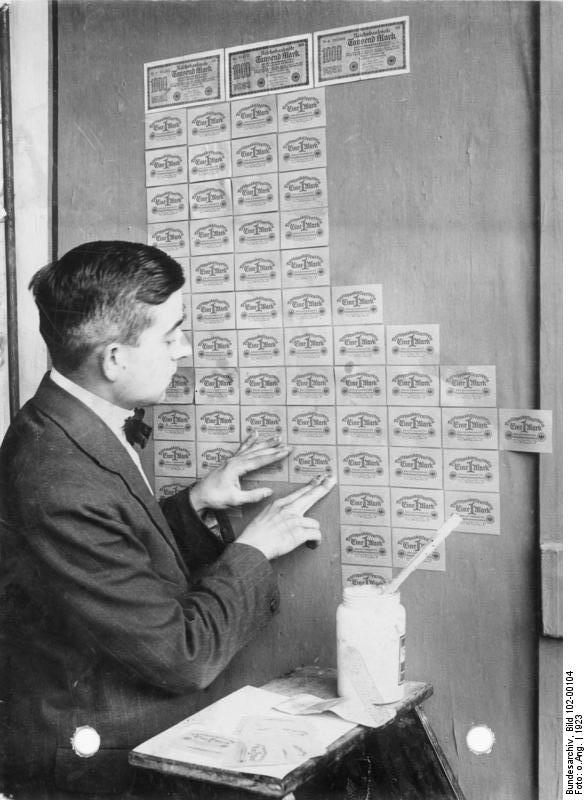

The German Hyperinflation

|

| The numbers tell the story. |

And because a picture is worth a thousand words:

Such monetary devastation, of course, destroyed the purchasing power of money such that:

|

| German children used bricks of cash as blocks with which to play. |

And

|

| People used German Marks as wallpaper. |

The frightening thing is that, if the Fed does not figure out a way to smoothly unwind our current massive monetary base,

as the old war poster says:

Subscribe to:

Comments (Atom)