One of the commonly-cited reasons for the existence of the Federal Reserve is to stabilize financial markets and thereby the economy. Ben Bernanke repeated this claim during one of his recent lectures at Georgetown.

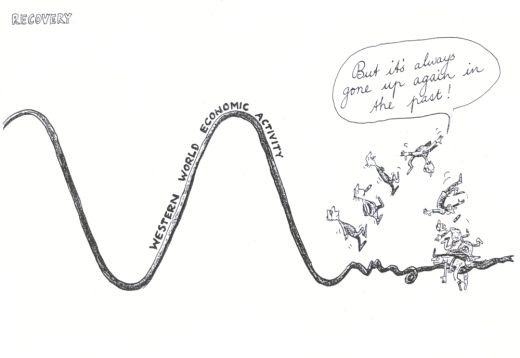

One of the commonly-cited reasons for the existence of the Federal Reserve is to stabilize financial markets and thereby the economy. Ben Bernanke repeated this claim during one of his recent lectures at Georgetown.Those who understand sound capital theory recognize, however, that the Fed is actually in the de-stabilization business. At the macroeconomic level, the Fed, when it acts to lower interest rates, bankrolls artificial credit expansion (lending not funded by voluntary savings), this stimulates malinvestment by encouraging too much investment at production stages away from consumption and not enough investment at stages closer too consumption. The stock of existing capital goods gets stretched both ways, until a crisis occurs, resulting in recession and liquidation.

A story from Bloomberg news last month documents a certain path some of the malinvestment takes at the microeconomic level. Because the Fed has done everything it can to drive interest rates into the ground, individual investors are taking on more risk is search of higher returns. No doubt this behavior is encouraged because the U. S. Government has a recent track record that clearly communicates it is ready to bail out any investment that is big and bad enough.

No comments:

Post a Comment