Two days ago Roger Lowenstein had an interesting piece in the New York Times about how the practice of the Federal Reserve has significantly departed from the purposes for which its founders ostensible created it. (For the real scoop on how the FED came to be, I recommend Rothbard's Case Against the Fed and Part 2 his A History of Money and Banking in the United States).

Two days ago Roger Lowenstein had an interesting piece in the New York Times about how the practice of the Federal Reserve has significantly departed from the purposes for which its founders ostensible created it. (For the real scoop on how the FED came to be, I recommend Rothbard's Case Against the Fed and Part 2 his A History of Money and Banking in the United States).As Lowenstein notes, the FED's early opponents had much insight on what the FED would really become. In Congressional debate leading up to the Federal Reserve Act's eventual passage, Representative Charles Lindbergh, Sr. argued that the central bank would become "the most gigantic trust on earth" and function as "an invisible government behind the money power." Elihu Root predicted that the FED would foster a currency that is all expansion with no contraction.

The propaganda of the FED's advocates, on the other hand, said the country needed a central bank to provide for an "elastic currency" that would expand and contract with the needs of commerce. It was claimed that such an elastic currency would eliminate financial panics of the sort experiences in 1907.

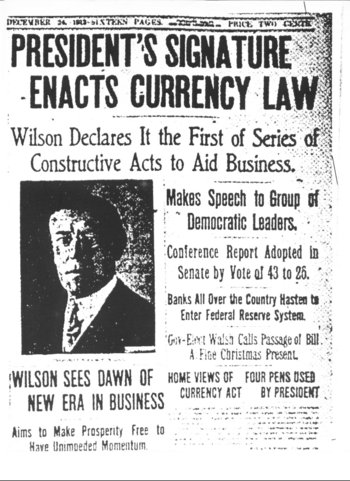

After the Federal Reserve Act was signed into law in late 1913, the following year's Annual Report of the Secretary of the Treasury included a stunningly naive forecast. It was claimed that, because the FED would provide a sufficiently elastic money stock,

Under that operation of this law such financial and commercial crises, or 'panics,' as this country experienced in 1873, 1893, and again in 1907, with their attendant misfortunes and prostrations, seem to be mathematically impossible (p. 479).

No comments:

Post a Comment