His comments reveal the extent of Bernanke's commitment to inflation and also the problems faced by a central money creator charged with a dual mandate that is often internally in conflict. As Bernanke notes in his speech, the Fed is charged by Congress to work to maximize employment and price stability. Over the course of the 2000s the Fed repeatedly held interest rates too low as a means to keep unemployment low. It appeared to work for awhile as unemployment did stay relatively low and at the same time there was not much increase in the CPI. Notwithstanding the tremendous increase in the prices of equities and houses, it appeared to many that the Fed had successfully continued the Great Moderation.

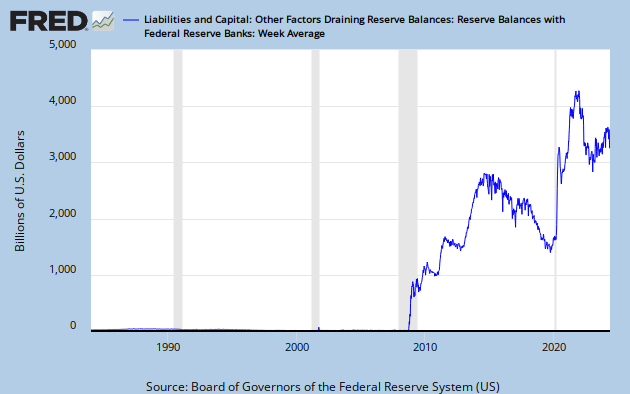

Unfortunately, as Misesian economists predicted, massive inflation of the money supply via credit expansion leads to massive capital malinvestment, which necessarily results in a recession, the effects we are still painfully enduring. Bernanke has responded as expected by pouring tremendous amounts of reserves into commercial banks to the extent that the Federal Funds rate remains at an all time low.

|

| Bank Reserves Increased to an All-time High |

|

| The Federal Funds Rate is Still at an All-time Low |

Now, however, Bernanke is concerned he has inflated himself into a corner, because rates are so low, he is worried that he may have hit a limit in how effective conventional monetary policy can be. Never mind that the prices of stock equities and commodities are on the rise as well as important sectors of producer prices. The fact that the CPI is not rising fast enough to create inflationary expectations so that an inflation premium is not being added to market interest rates constrains the effectiveness of expansionary monetary policy. The way to combat the scourge of prices not rising enough is to pour more money into the economy. Bernanke is no longer merely a deflation-phobe. He is a not-high-enough-inflation-phobe.

No comments:

Post a Comment